Rising Biopharmaceutical Demand

The increasing demand for biopharmaceuticals is a primary driver of the host cell-protein-testing market. As the biopharmaceutical sector expands, the need for rigorous testing of host cell proteins becomes critical to ensure product safety and efficacy. In the US, the biopharmaceutical market is projected to reach approximately $500 billion by 2025, indicating a robust growth trajectory. This surge necessitates advanced testing methodologies to detect and quantify host cell proteins, which can potentially impact therapeutic outcomes. Consequently, companies are investing in innovative testing solutions to meet regulatory standards and consumer expectations. The host cell-protein-testing market is thus positioned to benefit from this upward trend, as manufacturers seek to enhance their testing capabilities to align with the growing biopharmaceutical landscape.

Stringent Regulatory Frameworks

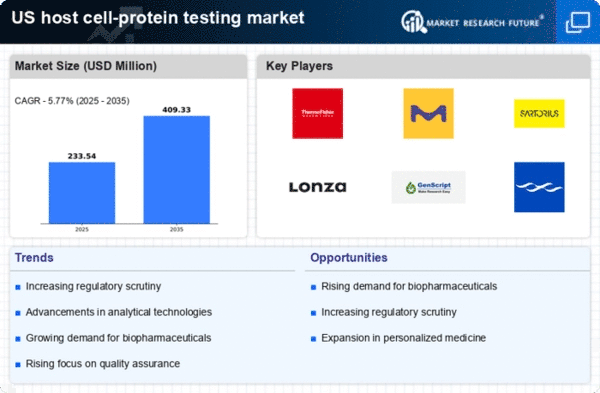

The host cell-protein-testing market is significantly influenced by stringent regulatory frameworks established by agencies such as the FDA. These regulations mandate comprehensive testing of host cell proteins to ensure the safety and quality of biopharmaceutical products. As regulatory bodies continue to emphasize the importance of thorough testing, companies are compelled to adopt advanced testing technologies and methodologies. This compliance not only mitigates risks associated with product recalls but also enhances consumer trust in biopharmaceuticals. The market is expected to grow as organizations invest in compliance-driven testing solutions, with the US market projected to expand at a CAGR of around 8% over the next few years. Thus, the regulatory landscape serves as a crucial driver for the host cell-protein-testing market.

Growing Awareness of Product Safety

There is a growing awareness of product safety among consumers and healthcare professionals, which is driving the host cell-protein-testing market. As patients become more informed about the potential risks associated with biopharmaceuticals, the demand for transparency in testing practices has intensified. This shift in consumer behavior compels manufacturers to prioritize rigorous testing of host cell proteins to ensure the safety and efficacy of their products. In the US, public health initiatives and educational campaigns are further promoting the importance of safety in biopharmaceuticals. Consequently, the host cell-protein-testing market is likely to experience increased demand as companies strive to meet consumer expectations and regulatory requirements, thereby enhancing their market position.

Technological Innovations in Testing

Technological innovations play a pivotal role in shaping the host cell-protein-testing market. The advent of advanced analytical techniques, such as mass spectrometry and high-performance liquid chromatography, has revolutionized the detection and quantification of host cell proteins. These technologies enable more accurate and efficient testing, which is essential for biopharmaceutical manufacturers aiming to comply with regulatory standards. The integration of automation and artificial intelligence in testing processes further enhances throughput and reliability. As the industry continues to evolve, the demand for cutting-edge testing solutions is likely to increase, driving growth in the host cell-protein-testing market. Companies that leverage these innovations may gain a competitive edge, positioning themselves favorably in a rapidly changing landscape.

Expansion of Biomanufacturing Facilities

The expansion of biomanufacturing facilities in the US is a significant driver of the host cell-protein-testing market. As companies scale up production to meet the rising demand for biopharmaceuticals, the need for comprehensive testing of host cell proteins becomes paramount. New facilities are being equipped with state-of-the-art testing laboratories to ensure compliance with regulatory standards and to maintain product quality. This trend is expected to contribute to the growth of the host cell-protein-testing market, as manufacturers invest in advanced testing technologies to support their operations. The establishment of these facilities not only enhances production capacity but also creates a demand for skilled professionals in the testing domain, further driving market growth.