Rising Disposable Income

The increase in disposable income among the Indian middle class is a significant driver for the India hearing aids market. As economic growth continues, more individuals are likely to allocate a portion of their income towards healthcare and wellness products, including hearing aids. This trend is particularly evident in urban areas, where rising living standards are fostering a greater willingness to invest in personal health. Market analysis suggests that the demand for premium hearing aids is on the rise, as consumers seek high-quality products that offer advanced features. Consequently, the india hearing aids market is poised for growth, as the purchasing power of consumers enhances their ability to invest in effective hearing solutions.

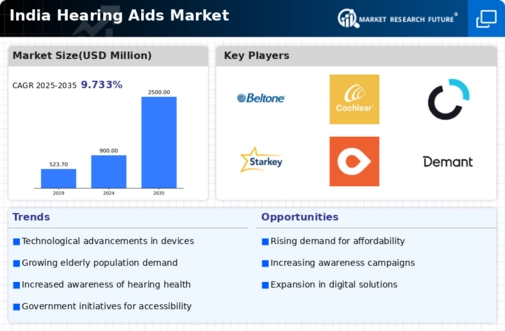

Technological Innovations

Technological advancements are transforming the India hearing aids market, leading to the development of more sophisticated and user-friendly devices. Innovations such as Bluetooth connectivity, rechargeable batteries, and artificial intelligence integration are becoming increasingly prevalent. These features not only enhance the user experience but also improve sound quality and personalization. According to industry reports, the market for smart hearing aids is anticipated to grow significantly, with a projected CAGR of over 10% in the coming years. This growth is indicative of a shift towards more advanced solutions that cater to the evolving needs of consumers. As technology continues to advance, the india hearing aids market is likely to see a proliferation of products that offer enhanced functionality and convenience.

Increased Health Awareness

There is a growing awareness regarding hearing health among the Indian population, which is significantly influencing the India hearing aids market. Public health campaigns and educational initiatives are shedding light on the importance of early detection and intervention for hearing loss. This heightened awareness is likely to lead to an increase in the number of individuals seeking hearing assessments and, subsequently, purchasing hearing aids. Recent surveys indicate that a considerable percentage of the population is now more informed about the available options for hearing assistance. Consequently, the india hearing aids market is expected to benefit from this trend, as more consumers recognize the value of investing in their hearing health.

Rising Geriatric Population

The increasing geriatric population in India is a pivotal driver for the India hearing aids market. As per recent demographic data, the proportion of individuals aged 60 and above is projected to reach 20% by 2030. This demographic shift is likely to result in a higher prevalence of age-related hearing loss, thereby escalating the demand for hearing aids. The india hearing aids market is expected to witness a surge in product offerings tailored to this age group, including user-friendly devices that cater to their specific needs. Furthermore, the growing trend of aging in place may encourage older adults to invest in hearing aids, enhancing their quality of life and independence. This demographic trend underscores the necessity for innovative solutions within the india hearing aids market.

Government Policies and Subsidies

Government initiatives aimed at improving accessibility to healthcare services are playing a crucial role in shaping the India hearing aids market. Various state and central government programs are being implemented to provide financial assistance and subsidies for hearing aids, particularly for low-income families. These policies are designed to reduce the financial burden associated with acquiring hearing aids, thereby increasing their accessibility. For instance, the introduction of schemes that offer reimbursement for hearing aids has the potential to expand the consumer base significantly. As these initiatives gain traction, the india hearing aids market is likely to experience a boost in sales, as more individuals are empowered to seek the necessary assistance for their hearing impairments.