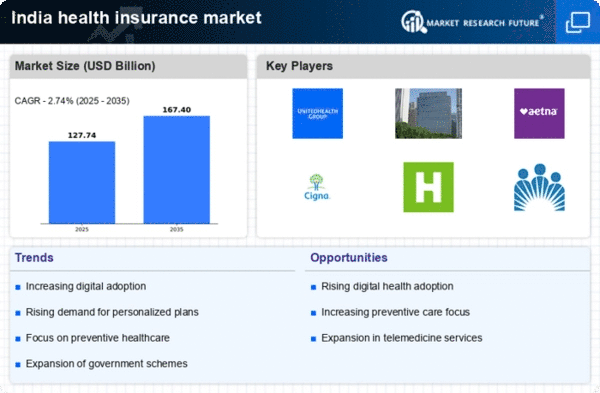

The health insurance market in India is currently characterized by a dynamic competitive landscape, driven by increasing consumer awareness, regulatory changes, and a growing emphasis on digital health solutions. Major players such as UnitedHealth Group (US), Cigna (US), and Allianz (DE) are actively shaping the market through strategic initiatives aimed at enhancing service delivery and expanding their customer base. UnitedHealth Group (US) has focused on integrating technology into its service offerings, thereby improving customer engagement and operational efficiency. Cigna (US), on the other hand, has been emphasizing partnerships with local healthcare providers to enhance its service network, which appears to be a strategic move to increase its market penetration. Allianz (DE) has been investing in innovative health solutions, indicating a commitment to adapting to the evolving needs of consumers in India.

The business tactics employed by these companies reflect a trend towards localization and optimization of services. The market structure is moderately fragmented, with a mix of established players and emerging startups. This fragmentation allows for diverse offerings, but also intensifies competition among key players. The collective influence of these companies is significant, as they not only compete on pricing but also on the quality and accessibility of their services, which is becoming increasingly important in consumer decision-making.

In September 2025, Cigna (US) announced a strategic partnership with a leading telemedicine provider in India, aiming to enhance its digital health services. This partnership is likely to bolster Cigna's position in the market by providing customers with easier access to healthcare services, thereby aligning with the growing trend of digital health solutions. The strategic importance of this move lies in its potential to attract a tech-savvy demographic that prioritizes convenience and accessibility in healthcare.

In October 2025, UnitedHealth Group (US) launched a new AI-driven health management platform tailored for the Indian market. This initiative is indicative of the company's commitment to leveraging technology to improve health outcomes and streamline operations. The introduction of such a platform may not only enhance customer experience but also provide UnitedHealth with a competitive edge in a market that is increasingly leaning towards digital solutions.

In August 2025, Allianz (DE) expanded its health insurance offerings by introducing a new product line focused on preventive care and wellness programs. This strategic move reflects a growing recognition of the importance of preventive health measures in reducing long-term healthcare costs. By prioritizing wellness, Allianz is likely to attract health-conscious consumers, thereby differentiating itself in a crowded marketplace.

As of November 2025, the competitive trends in the health insurance market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are playing a crucial role in shaping the current landscape, as companies seek to enhance their service offerings and operational capabilities. Looking ahead, it appears that competitive differentiation will increasingly hinge on innovation and technology, rather than solely on price. The shift towards a more integrated and technology-driven approach suggests that companies will need to invest in reliable supply chains and innovative solutions to meet the evolving demands of consumers.

Leave a Comment