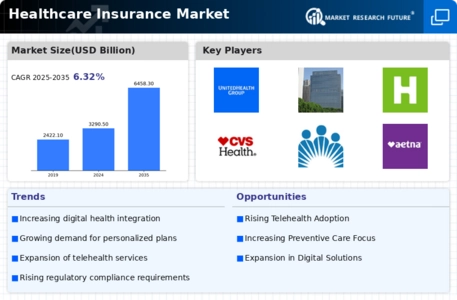

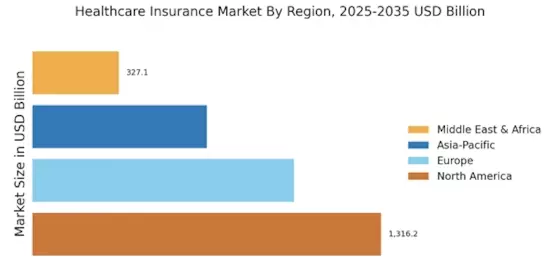

North America : Healthcare Innovation Leader

North America, particularly the United States, is the largest market for healthcare insurance, holding approximately 40% of the global market share. Key growth drivers include an aging population, increasing healthcare costs, and a shift towards value-based care. Regulatory catalysts such as the Affordable Care Act continue to shape the landscape, promoting wider access to insurance and enhancing consumer protections. The competitive landscape is dominated by major players like UnitedHealth Group, Anthem, and Aetna, which are continuously innovating to meet consumer demands. The presence of these key players fosters a dynamic market environment, with a focus on technology integration and personalized healthcare solutions. The U.S. market is characterized by a mix of private and public insurance options, ensuring a diverse range of services for consumers.

Europe : Evolving Healthcare Framework

Europe is witnessing significant growth in the healthcare insurance market, driven by regulatory reforms and an increasing emphasis on universal healthcare coverage. The region holds approximately 30% of the global market share, with Germany and France being the largest contributors. The European Union's regulations on cross-border healthcare and insurance portability are key catalysts for market expansion, enhancing consumer access and choice. Leading countries like Germany, France, and the UK are at the forefront of this evolving landscape, with a mix of public and private insurance models. Major players such as Allianz and AXA are adapting to changing consumer needs, focusing on digital health solutions and personalized services. The competitive environment is characterized by innovation and collaboration among insurers, healthcare providers, and technology firms, aiming to improve patient outcomes and operational efficiency.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is emerging as a significant player in the healthcare insurance market, with a market share of approximately 20%. The region's growth is fueled by rising disposable incomes, increasing healthcare awareness, and government initiatives aimed at expanding insurance coverage. Countries like China and India are leading this growth, supported by regulatory reforms that promote private insurance participation and enhance healthcare access. The competitive landscape is becoming increasingly dynamic, with local and international players vying for market share. Key players such as Ping An Insurance and China Life are expanding their offerings to cater to the diverse needs of consumers. The focus on digital health solutions and telemedicine is reshaping the market, providing innovative ways to deliver healthcare services and improve patient engagement.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is witnessing a gradual but steady growth in the healthcare insurance market, holding approximately 10% of the global market share. Key drivers include increasing healthcare expenditure, a growing middle class, and government initiatives aimed at improving healthcare access. Countries like South Africa and the UAE are leading the charge, with regulatory frameworks that encourage private insurance participation and enhance consumer protection. The competitive landscape is characterized by a mix of local and international insurers, with key players such as Discovery Health and Sanlam making significant inroads. The focus on improving healthcare infrastructure and expanding insurance coverage is driving innovation in product offerings. As the region continues to develop, opportunities for growth in healthcare insurance are becoming increasingly apparent, attracting investment and fostering competition.