Rising Healthcare Costs

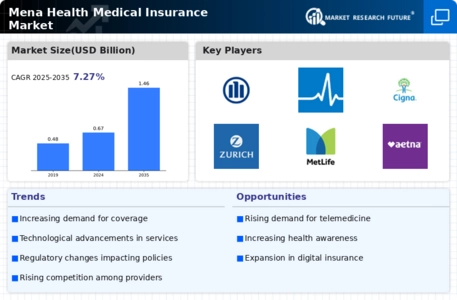

The Mena Health Medical Insurance Market is experiencing a notable increase in healthcare costs, which is driving demand for medical insurance. As healthcare expenses continue to rise, individuals and families are seeking comprehensive insurance solutions to mitigate financial burdens. Reports indicate that healthcare spending in the MENA region has escalated, with projections suggesting a compound annual growth rate of approximately 8% over the next five years. This trend compels consumers to invest in health insurance policies that offer extensive coverage, thereby propelling the growth of the Mena Health Medical Insurance Market. Insurers are responding by developing innovative products that cater to the evolving needs of the population, ensuring that they remain competitive in a rapidly changing landscape.

Growing Awareness of Health Risks

There is a marked increase in public awareness regarding health risks and the importance of preventive care, which is positively impacting the Mena Health Medical Insurance Market. As individuals become more informed about health issues, they are more inclined to seek insurance coverage that includes preventive services. This shift in consumer behavior is reflected in market data, which shows a rising trend in the purchase of policies that offer wellness programs and preventive screenings. Insurers are adapting to this demand by incorporating wellness incentives into their plans, thereby enhancing their appeal. The growing emphasis on health management is likely to drive further growth in the Mena Health Medical Insurance Market, as consumers prioritize their health and well-being.

Demographic Changes and Urbanization

Demographic changes, particularly urbanization and population growth, are significantly influencing the Mena Health Medical Insurance Market. The region is witnessing a rapid increase in urban populations, which is associated with a higher demand for healthcare services and insurance coverage. As urban centers expand, the need for accessible and affordable healthcare becomes more pronounced, prompting individuals to seek insurance solutions. Market analysis indicates that urban populations in MENA countries are expected to rise by over 30% in the next decade, creating a substantial market for health insurance providers. This demographic shift is likely to drive innovation and competition within the Mena Health Medical Insurance Market, as insurers strive to cater to the diverse needs of a growing urban populace.

Government Initiatives and Regulations

Government initiatives aimed at enhancing healthcare access and affordability are significantly influencing the Mena Health Medical Insurance Market. Various MENA countries are implementing regulations that mandate health insurance coverage for citizens and residents, thereby expanding the insured population. For instance, countries like Saudi Arabia and the UAE have introduced policies that require employers to provide health insurance to their employees. This regulatory environment is expected to increase the penetration of health insurance in the region, with estimates indicating that the insured population could grow by over 20% in the next few years. Such initiatives not only promote public health but also stimulate competition among insurers, leading to improved service offerings in the Mena Health Medical Insurance Market.

Technological Advancements in Insurance

Technological advancements are reshaping the Mena Health Medical Insurance Market, enabling insurers to offer more efficient and customer-centric services. The integration of digital platforms and telemedicine is facilitating easier access to healthcare services, which is becoming increasingly important for consumers. Data suggests that the adoption of technology in insurance processes, such as claims management and customer service, is enhancing operational efficiency and customer satisfaction. Insurers are leveraging big data analytics to tailor their offerings, thereby meeting the specific needs of their clients. This technological evolution is likely to attract a broader customer base, further propelling the growth of the Mena Health Medical Insurance Market as companies strive to remain relevant in a tech-driven environment.