Rising Prevalence of Chronic Diseases

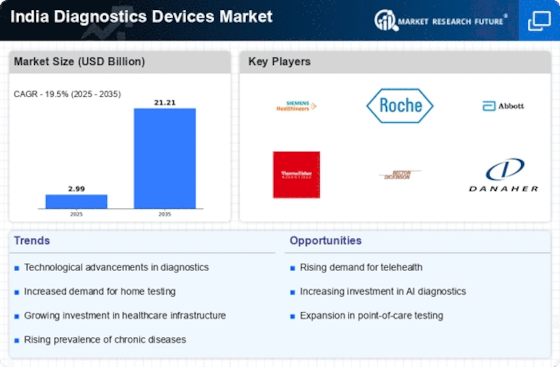

The increasing incidence of chronic diseases in India is a pivotal driver for the India Diagnostics Devices Market. As lifestyle-related ailments such as diabetes, cardiovascular diseases, and respiratory disorders become more prevalent, the demand for diagnostic devices is expected to surge. According to recent estimates, chronic diseases account for approximately 60% of all deaths in India, necessitating advanced diagnostic solutions. This trend compels healthcare providers to invest in innovative diagnostic technologies, thereby propelling market growth. The India Diagnostics Devices Market is likely to witness a robust expansion as healthcare systems adapt to the growing need for early detection and management of these conditions.

Government Initiatives and Investments

Government initiatives aimed at enhancing healthcare infrastructure significantly influence the India Diagnostics Devices Market. The Indian government has launched various programs to improve healthcare access and affordability, including the Ayushman Bharat scheme, which aims to provide health insurance to millions. Such initiatives are likely to stimulate investments in diagnostic technologies, as healthcare facilities upgrade their capabilities to meet the increased demand. Furthermore, the government's focus on promoting indigenous manufacturing of diagnostic devices could lead to a more competitive market landscape. This strategic direction may enhance the overall growth trajectory of the India Diagnostics Devices Market, fostering innovation and accessibility.

Growing Demand for Point-of-Care Testing

The shift towards point-of-care testing (POCT) is transforming the India Diagnostics Devices Market. POCT offers rapid results and convenience, making it increasingly popular among healthcare providers and patients alike. The market for POCT devices is projected to grow at a compound annual growth rate (CAGR) of over 10% in the coming years, driven by the need for timely diagnosis and treatment. This trend is particularly relevant in rural and underserved areas, where access to traditional laboratory facilities may be limited. As healthcare systems prioritize efficiency and patient-centric care, the India Diagnostics Devices Market is likely to expand in response to this growing demand for POCT solutions.

Technological Innovations in Diagnostic Devices

Technological advancements play a crucial role in shaping the India Diagnostics Devices Market. Innovations such as artificial intelligence, machine learning, and advanced imaging techniques are enhancing the accuracy and efficiency of diagnostic devices. These technologies enable healthcare professionals to make more informed decisions, ultimately improving patient outcomes. The integration of digital health solutions, including telemedicine and remote monitoring, is also gaining traction, further driving the demand for sophisticated diagnostic tools. As the market evolves, the continuous introduction of cutting-edge technologies is expected to propel the growth of the India Diagnostics Devices Market, fostering a more effective healthcare ecosystem.

Increasing Health Awareness and Preventive Healthcare

The rising health consciousness among the Indian population is a significant driver for the India Diagnostics Devices Market. As individuals become more aware of the importance of regular health check-ups and preventive measures, the demand for diagnostic devices is likely to increase. Public health campaigns and educational initiatives are encouraging people to seek early diagnosis and treatment, thereby fostering a culture of preventive healthcare. This shift in mindset is expected to lead to a higher utilization of diagnostic services, which in turn could stimulate growth in the market. The India Diagnostics Devices Market stands to benefit from this trend as healthcare providers adapt to meet the evolving needs of a more health-conscious society.