Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in India are driving the point of-care-molecular-diagnostics market. The Indian government has launched various programs to enhance diagnostic capabilities, particularly in rural areas. For instance, the National Health Mission has allocated substantial funding to improve access to healthcare services, including diagnostic testing. This financial support is likely to encourage the development and deployment of innovative point-of-care technologies. As a result, the market is expected to witness a surge in new product launches and partnerships between public and private sectors, further propelling growth.

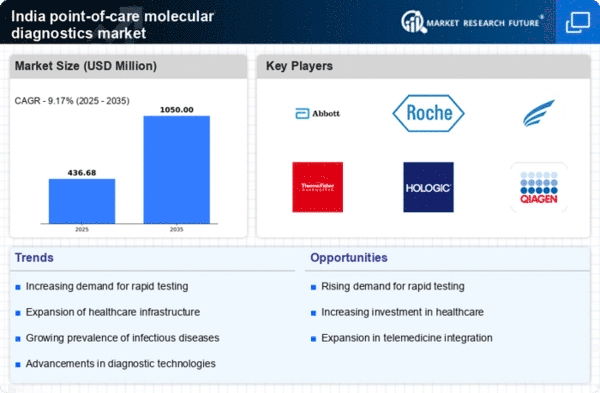

Rising Demand for Rapid Diagnostics

The increasing need for rapid diagnostic solutions in India is a key driver for the point of-care-molecular-diagnostics market. Healthcare providers are under pressure to deliver timely results, particularly in emergency settings. This demand is reflected in the growing adoption of point-of-care testing (POCT) technologies, which can provide results in a matter of minutes. According to recent estimates, the market for rapid diagnostics in India is projected to grow at a CAGR of approximately 15% over the next five years. This trend is likely to enhance the overall efficiency of healthcare delivery, making it a crucial factor in the expansion of the point of-care-molecular-diagnostics market.

Growing Awareness of Personalized Medicine

The increasing awareness and acceptance of personalized medicine in India are influencing the point of-care-molecular-diagnostics market. As healthcare providers and patients alike recognize the benefits of tailored treatment plans based on individual genetic profiles, the demand for molecular diagnostics is expected to rise. This shift towards personalized healthcare is likely to drive innovation in diagnostic technologies, leading to the development of more sophisticated point-of-care solutions. Market analysts suggest that this trend could result in a significant increase in the adoption of molecular diagnostics, potentially expanding the market by over 20% in the coming years.

Increased Prevalence of Infectious Diseases

The rising incidence of infectious diseases in India is significantly impacting the point of-care-molecular-diagnostics market. With diseases such as tuberculosis, malaria, and various viral infections becoming more prevalent, there is an urgent need for effective diagnostic tools that can be deployed in remote and underserved areas. The World Health Organization has reported that India accounts for a substantial share of the global burden of infectious diseases. This scenario creates a favorable environment for the adoption of molecular diagnostics, which can provide accurate and rapid results, thereby facilitating timely treatment and control measures.

Technological Innovations in Diagnostic Tools

Technological advancements in diagnostic tools are a major driver of the point-of-care-molecular-diagnostics market. Innovations such as microfluidics, lab-on-a-chip technologies, and portable devices are enhancing the capabilities of molecular diagnostics. These advancements allow for more accurate, faster, and cost-effective testing solutions, which are particularly beneficial in resource-limited settings. The Indian market is witnessing a surge in the development of such technologies, with several startups and established companies investing in research and development. This focus on innovation is likely to create new opportunities and drive growth in the point-of-care-molecular-diagnostics market.