Government Initiatives and Support

Government initiatives aimed at improving healthcare infrastructure are playing a pivotal role in the growth of the India CBCT dental imaging market. The Indian government has launched various programs to enhance dental care accessibility, particularly in rural areas. These initiatives often include financial support for dental clinics to acquire advanced imaging technologies, including CBCT systems. Additionally, regulatory bodies are establishing guidelines to ensure the safe and effective use of dental imaging technologies. As a result, the market is witnessing an influx of new players and increased competition, which is likely to drive innovation and reduce costs for consumers. This supportive environment is expected to further stimulate the adoption of CBCT imaging in dental practices across the country.

Increasing Awareness of Oral Health

The growing awareness of oral health among the Indian population is significantly influencing the India CBCT dental imaging market. Public health campaigns and educational initiatives are emphasizing the importance of early detection and prevention of dental diseases. This heightened awareness is leading to an increase in patient visits to dental clinics, where advanced imaging technologies like CBCT are being utilized for accurate diagnosis. According to recent surveys, nearly 70% of urban residents are now aware of the benefits of advanced dental imaging, which is likely to drive demand for CBCT services. As a result, dental practitioners are increasingly adopting CBCT technology to meet patient expectations and improve treatment outcomes.

Rising Incidence of Dental Disorders

The India CBCT dental imaging market is also being propelled by the rising incidence of dental disorders, including caries, periodontal diseases, and oral cancers. The World Health Organization has reported that dental diseases are among the most prevalent non-communicable diseases in India, affecting a significant portion of the population. This alarming trend is prompting dental professionals to seek advanced imaging solutions to facilitate accurate diagnosis and treatment planning. The demand for CBCT imaging is expected to rise as practitioners recognize its advantages in visualizing complex dental structures and pathologies. Consequently, the market is likely to expand as more dental clinics incorporate CBCT technology into their diagnostic protocols.

Expansion of Dental Clinics and Practices

The rapid expansion of dental clinics and practices across India is significantly contributing to the growth of the India CBCT dental imaging market. With an increasing number of dental professionals establishing their practices, there is a corresponding rise in the demand for advanced diagnostic tools. Many new clinics are opting for CBCT systems to differentiate themselves in a competitive market and offer comprehensive services to patients. As of January 2026, it is estimated that the number of dental clinics utilizing CBCT technology has increased by over 30% in the past three years. This trend indicates a growing recognition of the value of advanced imaging in enhancing patient care and treatment outcomes, thereby driving the overall market growth.

Technological Advancements in Imaging Systems

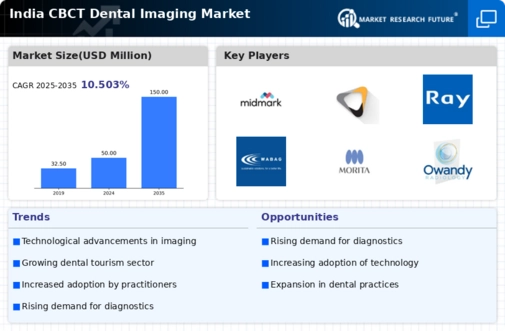

The India CBCT dental imaging market is experiencing a surge in technological advancements, which are enhancing the precision and efficiency of dental diagnostics. Innovations such as high-resolution imaging, faster scanning times, and improved software for image analysis are becoming increasingly prevalent. For instance, the introduction of AI-driven diagnostic tools is streamlining the interpretation of CBCT images, thereby reducing the time required for diagnosis. As of January 2026, the market is projected to grow at a CAGR of approximately 12% over the next five years, driven by these technological improvements. Furthermore, the integration of 3D imaging capabilities is allowing dental professionals to visualize complex anatomical structures more effectively, which is crucial for treatment planning and surgical procedures.