Expansion of Digital Infrastructure

The expansion of digital infrastructure in India is a crucial driver for the blockchain service market. With the government's push towards a digital economy, there has been a substantial increase in internet penetration and mobile connectivity. As of 2025, internet penetration in India stands at approximately 70%, facilitating greater access to digital services. This enhanced connectivity enables businesses and consumers to engage with blockchain applications more effectively. Furthermore, the proliferation of cloud computing and data centers supports the deployment of blockchain solutions, making them more accessible to a wider audience. The expansion of digital infrastructure is likely to foster innovation and adoption within the blockchain service market, as it provides the necessary foundation for the technology to thrive in various sectors.

Rising Demand for Secure Transactions

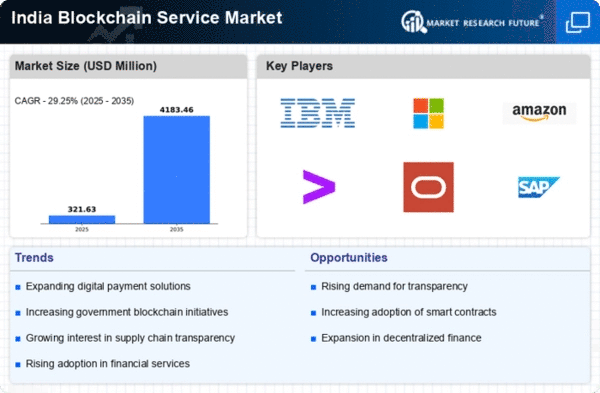

The blockchain service market in India is experiencing a notable surge in demand for secure transaction solutions. As businesses increasingly seek to mitigate fraud and enhance data integrity, blockchain technology offers a decentralized and tamper-proof method for conducting transactions. This demand is particularly pronounced in sectors such as finance and e-commerce, where the need for secure payment gateways is paramount. According to recent estimates, the market for blockchain services in India is projected to grow at a CAGR of approximately 45% from 2023 to 2028. This growth is indicative of the broader trend towards digital transformation, where organizations are prioritizing security and transparency in their operations. Consequently, the rising demand for secure transactions is a critical driver for the blockchain service market, as it aligns with the evolving needs of businesses and consumers alike.

Growing Need for Regulatory Compliance

The market in India is being propelled by the growing need for regulatory compliance across various sectors. As industries face increasing scrutiny from regulatory bodies, the demand for transparent and auditable systems is on the rise. Blockchain technology provides an effective solution by enabling real-time tracking and verification of transactions, which is essential for compliance with regulations. For instance, sectors such as finance and healthcare are particularly affected, as they must adhere to stringent guidelines regarding data handling and reporting. The emphasis on regulatory compliance is expected to drive the adoption of blockchain services, as organizations seek to leverage the technology to ensure adherence to legal requirements. This growing need for compliance is thus a significant driver for the blockchain service market, as it aligns with the broader trend of accountability and transparency in business practices.

Increased Investment in Blockchain Startups

Investment in blockchain startups is significantly influencing the blockchain service market in India. Venture capitalists and private equity firms are increasingly recognizing the potential of blockchain technology to disrupt traditional business models. In 2025, investments in Indian blockchain startups reached approximately $1.5 billion, reflecting a growing confidence in the technology's capabilities. This influx of capital not only supports innovation but also fosters the development of new applications and services within the blockchain ecosystem. As startups continue to emerge, they are likely to drive competition and enhance service offerings, thereby expanding the overall market. The increased investment in blockchain startups is thus a vital driver, as it propels advancements in technology and encourages the adoption of blockchain solutions across various industries.

Emergence of Decentralized Finance (DeFi) Solutions

The emergence of decentralized finance (DeFi) solutions is reshaping the landscape of the blockchain service market in India. DeFi platforms, which leverage blockchain technology to offer financial services without traditional intermediaries, are gaining traction among users seeking greater control over their assets. In 2025, the total value locked in DeFi protocols in India is estimated to exceed $500 million, indicating a robust interest in alternative financial systems. This trend is particularly appealing to younger demographics who are more inclined to explore innovative financial solutions. The rise of DeFi is likely to drive the adoption of blockchain services, as it encourages users to engage with the technology for various financial transactions. Consequently, the emergence of DeFi solutions serves as a pivotal driver for the blockchain service market, reflecting a shift towards more democratized financial services.