Rising Demand for Secure Transactions

The blockchain service market in South America experiences a notable surge in demand for secure transaction methods. As businesses and consumers increasingly prioritize data security, the adoption of blockchain technology appears to provide a robust solution. In 2025, it is estimated that the market for blockchain services in the region could reach approximately $1.5 billion, driven by the need for enhanced security protocols. This demand is particularly pronounced in sectors such as finance and e-commerce, where transaction integrity is paramount. The blockchain service market is thus positioned to benefit from this trend, as organizations seek to mitigate risks associated with fraud and cyber threats. Furthermore, the integration of blockchain solutions is likely to foster greater trust among users, potentially leading to increased transaction volumes and customer loyalty.

Emergence of Decentralized Applications

The rise of decentralized applications (dApps) is significantly influencing the blockchain service market in South America. These applications, which operate on blockchain networks, offer users enhanced privacy and control over their data. As of November 2025, the number of dApps in the region is projected to grow by over 30%, reflecting a shift towards more user-centric digital solutions. This trend is particularly relevant in sectors such as gaming and social media, where user engagement is critical. The blockchain service market is likely to capitalize on this growth, as developers and businesses increasingly seek to create innovative dApps that leverage blockchain's unique capabilities. The potential for dApps to disrupt traditional business models may further accelerate investment in blockchain services, fostering a vibrant ecosystem of digital solutions across South America.

Increased Investment in Blockchain Startups

Investment in blockchain startups is witnessing a significant uptick in South America, contributing to the growth of the blockchain service market. In 2025, venture capital funding for blockchain-related ventures in the region is expected to exceed $500 million, indicating a strong interest from investors. This influx of capital is likely to spur innovation and the development of new blockchain solutions tailored to local market needs. The blockchain service market stands to benefit from this trend, as startups introduce novel applications and services that address specific challenges faced by businesses and consumers. Moreover, the competitive landscape may intensify, prompting established companies to enhance their offerings and invest in partnerships with emerging players, thereby driving further growth in the sector.

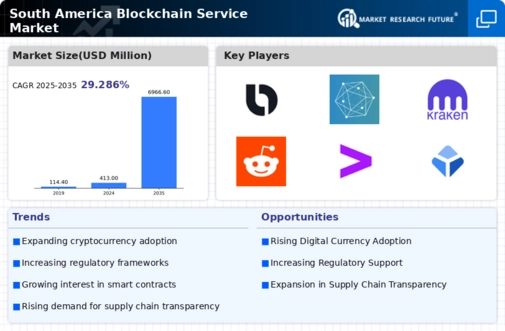

Regulatory Developments and Compliance Needs

The evolving regulatory landscape in South America is shaping the blockchain service market, as businesses navigate compliance requirements. Governments are increasingly recognizing the potential of blockchain technology, leading to the establishment of frameworks that promote its use while ensuring consumer protection. By November 2025, it is anticipated that regulatory clarity will enhance the attractiveness of blockchain services, potentially increasing market participation by 25%. The blockchain service market is likely to see a rise in demand for compliance-focused solutions, as organizations seek to align their operations with regulatory standards. This trend may also encourage collaboration between blockchain service providers and regulatory bodies, fostering a more conducive environment for innovation and growth.

Growing Interest in Digital Identity Solutions

The blockchain service market in South America is experiencing a growing interest in digital identity solutions, driven by the need for secure and verifiable identity management. As individuals and organizations seek to protect their personal information, blockchain technology offers a promising avenue for creating tamper-proof digital identities. By 2025, the market for blockchain-based identity solutions is projected to reach $300 million in the region. The blockchain service market is poised to capitalize on this trend, as businesses and governments explore ways to implement these solutions for various applications, including voting, healthcare, and financial services. The potential for blockchain to streamline identity verification processes may lead to increased efficiency and reduced fraud, further enhancing its appeal in the South American context.