Germany : Innovation and Investment Drive Growth

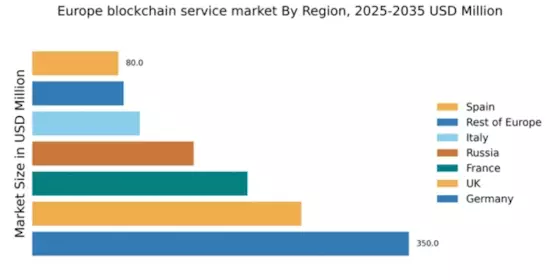

Germany holds a dominant position in the European blockchain service market, with a market value of $350.0 million, representing approximately 35% of the total market share. Key growth drivers include a robust tech ecosystem, significant venture capital investments, and a supportive regulatory framework. The German government has initiated various programs to foster blockchain innovation, enhancing infrastructure and industrial development, particularly in sectors like finance and logistics.

UK : Financial Services Fueling Adoption

The UK blockchain service market is valued at $250.0 million, accounting for about 25% of the European market. The financial services sector is a primary driver, with banks and fintech companies increasingly adopting blockchain for efficiency and transparency. Regulatory bodies are actively working on frameworks to support innovation while ensuring consumer protection, which has led to a favorable business environment for blockchain startups and established firms alike.

France : Government Support and Innovation

France's blockchain service market is valued at $200.0 million, representing 20% of the European market. The French government has launched initiatives to promote blockchain technology, particularly in public services and supply chain management. Demand is growing in sectors like healthcare and finance, driven by the need for transparency and security. The Paris region is a key hub, attracting both startups and established players in the blockchain space.

Russia : Regulatory Landscape and Opportunities

Russia's blockchain service market is valued at $150.0 million, making up 15% of the European market. Despite regulatory uncertainties, there is a growing interest in blockchain applications across various sectors, including energy and finance. The government is exploring regulatory frameworks to support blockchain innovation, which could enhance market growth. Key cities like Moscow and St. Petersburg are central to this development, hosting numerous blockchain initiatives.

Italy : Manufacturing and Finance Lead Growth

Italy's blockchain service market is valued at $100.0 million, representing 10% of the European market. The manufacturing and finance sectors are leading the adoption of blockchain technology, driven by the need for improved traceability and efficiency. Government initiatives are focused on fostering innovation and collaboration among businesses. Cities like Milan and Turin are emerging as key centers for blockchain development, attracting both local and international players.

Spain : Startups and Government Initiatives

Spain's blockchain service market is valued at $80.0 million, accounting for about 8% of the European market. The Spanish government is actively promoting blockchain technology through various initiatives aimed at enhancing digital transformation. The startup ecosystem is vibrant, with numerous companies exploring blockchain applications in sectors like tourism and finance. Cities such as Barcelona and Madrid are at the forefront of this innovation, fostering a collaborative environment for tech development.

Rest of Europe : Regional Variations and Opportunities

The Rest of Europe blockchain service market is valued at $84.83 million, representing about 8.5% of the total market. This sub-region includes a mix of countries with varying levels of blockchain adoption and regulatory frameworks. Key growth drivers include local government initiatives and the increasing interest from SMEs in adopting blockchain solutions. Countries like Switzerland and the Netherlands are notable for their progressive policies and strong tech ecosystems, fostering innovation in blockchain applications.