Rising Demand for Transparency

The blockchain service market in North America experiences a notable surge in demand for transparency across various sectors. Organizations are increasingly adopting blockchain solutions to enhance traceability and accountability in their operations. This trend is particularly evident in supply chain management, where companies seek to provide consumers with verifiable information about product origins and handling. According to recent data, the adoption of blockchain technology in supply chains could potentially reduce costs by up to 20%. As businesses strive to build trust with consumers, the blockchain service market is likely to see continued growth driven by this demand for transparency.

Increased Cybersecurity Concerns

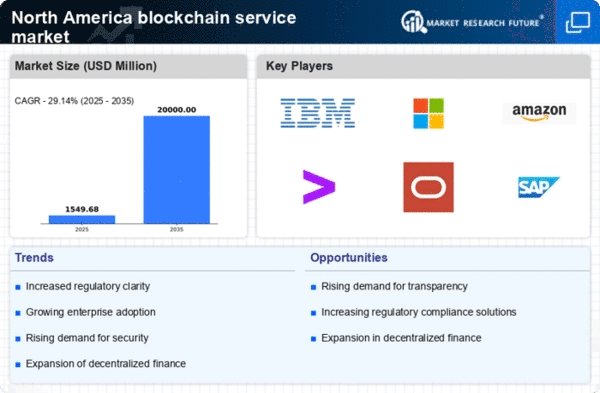

As cyber threats continue to evolve, the blockchain service market in North America is witnessing heightened interest in cybersecurity solutions. Blockchain technology offers robust security features, such as immutability and decentralized data storage, which are appealing to organizations seeking to protect sensitive information. The rise in data breaches has prompted businesses to explore blockchain as a means to enhance their cybersecurity posture. Reports indicate that the blockchain service market could see a growth rate of 30% annually as organizations prioritize security measures. This trend reflects a broader recognition of blockchain's potential to mitigate risks associated with cyber threats.

Integration with IoT Technologies

The convergence of blockchain technology with Internet of Things (IoT) devices is emerging as a pivotal driver for the blockchain service market in North America. This integration facilitates secure data sharing and enhances the efficiency of automated processes. For instance, smart contracts can autonomously execute transactions based on data collected from IoT devices, thereby reducing the need for intermediaries. The blockchain service market is projected to benefit significantly from this synergy, with estimates suggesting that the market for blockchain in IoT could reach $10 billion by 2026. This potential growth underscores the importance of IoT integration in driving blockchain adoption.

Expansion of Smart Contract Applications

The blockchain service market in North America is experiencing a significant expansion in the use of smart contracts across various industries. These self-executing contracts, with the terms of the agreement directly written into code, offer a range of benefits, including reduced transaction costs and increased efficiency. Industries such as real estate, healthcare, and legal services are beginning to adopt smart contracts to automate processes and enhance trust among parties. The blockchain service market is projected to grow as more organizations recognize the potential of smart contracts to transform traditional business practices, with estimates suggesting a market size of $5 billion by 2027.

Growing Interest from Financial Institutions

Financial institutions in North America are increasingly exploring blockchain technology to streamline operations and enhance service offerings. The blockchain service market is benefiting from this trend as banks and fintech companies invest in blockchain solutions for payment processing, asset management, and regulatory compliance. Recent surveys indicate that over 60% of financial institutions are actively considering blockchain initiatives, with many already piloting projects. This growing interest is likely to drive innovation and competition within the blockchain service market, as institutions seek to leverage the technology for improved efficiency and customer experience.