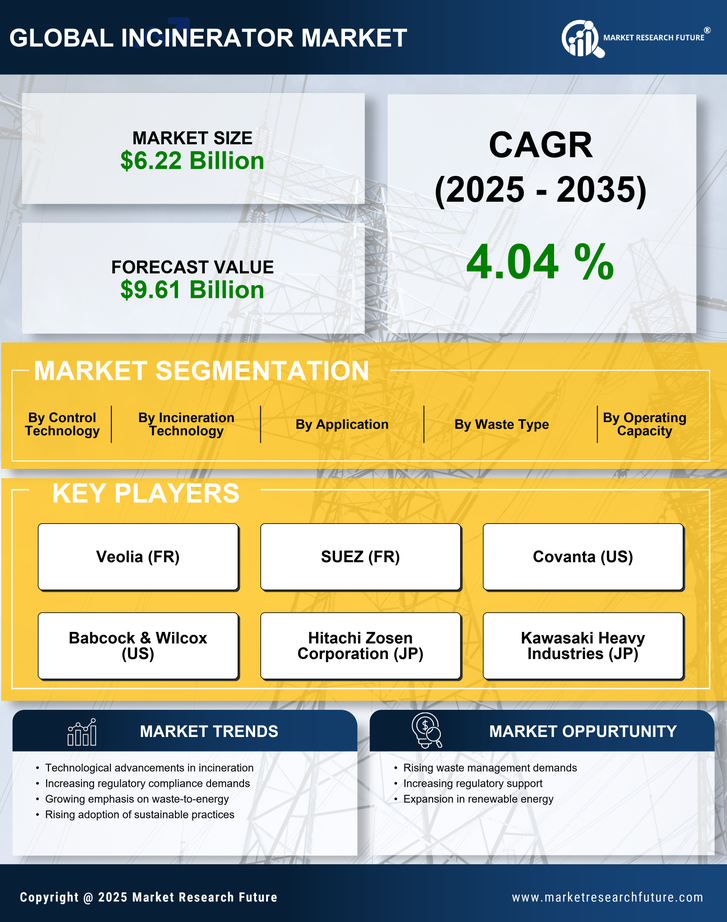

Energy Recovery Potential

The incinerator market is bolstered by the potential for energy recovery from waste materials. Incineration not only serves as a waste disposal method but also generates energy in the form of electricity and heat. This dual benefit aligns with the increasing demand for renewable energy sources. In many regions, waste-to-energy plants are being developed to harness this potential, with some facilities generating enough energy to power thousands of homes. The energy recovery aspect of incineration is becoming a focal point for policymakers and investors, as it contributes to energy security and sustainability goals. Consequently, the incinerator market is likely to expand as more stakeholders recognize the value of energy recovery.

Environmental Regulations

The incinerator market is significantly influenced by stringent environmental regulations aimed at reducing landfill usage and promoting waste-to-energy solutions. Governments are increasingly implementing policies that mandate waste treatment and disposal methods that minimize environmental impact. For instance, regulations may require a certain percentage of waste to be treated through incineration or other advanced technologies. This regulatory landscape encourages investments in modern incineration facilities that comply with emission standards. As a result, the incinerator market is likely to see a shift towards more efficient and environmentally friendly technologies, fostering innovation and growth.

Technological Innovations

The incinerator market is witnessing a wave of technological innovations that enhance the efficiency and effectiveness of waste treatment processes. Advanced incineration technologies, such as fluidized bed combustion and gasification, are being adopted to improve energy recovery and reduce emissions. These innovations not only optimize the combustion process but also enable the treatment of a wider variety of waste types. As technology continues to evolve, the incinerator market is expected to benefit from increased operational efficiency and reduced environmental impact. Furthermore, the integration of automation and monitoring systems in incineration facilities is likely to streamline operations and enhance compliance with regulatory standards.

Increasing Waste Generation

The incinerator market is experiencing growth due to the rising volume of waste generated across various sectors. Urbanization and population growth contribute to this trend, leading to an increase in municipal solid waste. According to recent estimates, waste generation is projected to reach 3.4 billion tons annually by 2050. This surge in waste necessitates efficient disposal methods, with incineration emerging as a viable solution. Incinerators not only reduce the volume of waste but also generate energy, making them an attractive option for waste management. As countries seek to manage waste sustainably, the demand for incineration technology is likely to rise, further propelling the incinerator market.

Public Awareness and Acceptance

The incinerator market is increasingly shaped by public awareness and acceptance of waste management practices. As communities become more informed about the environmental impacts of waste disposal, there is a growing recognition of the benefits of incineration as a sustainable solution. Public campaigns and educational initiatives are fostering a better understanding of how incineration can reduce landfill reliance and contribute to energy generation. This shift in public perception is crucial for the development of new incineration facilities, as community support often influences project approvals. As acceptance grows, the incinerator market is likely to see an uptick in investments and new projects aimed at addressing waste management challenges.