Rising Energy Demand

The increasing The Distributed Energy Generation Industry. As populations grow and economies develop, the need for reliable and sustainable energy sources intensifies. This demand surge is particularly evident in urban areas, where energy consumption is projected to rise by 30% by 2030. Distributed energy generation offers a viable solution to meet this demand, as it allows for localized energy production, reducing transmission losses and enhancing grid stability. Furthermore, the shift towards electrification in various sectors, including transportation and heating, further amplifies the need for distributed energy solutions. Consequently, this rising energy demand is likely to propel investments in distributed energy technologies.

Technological Advancements

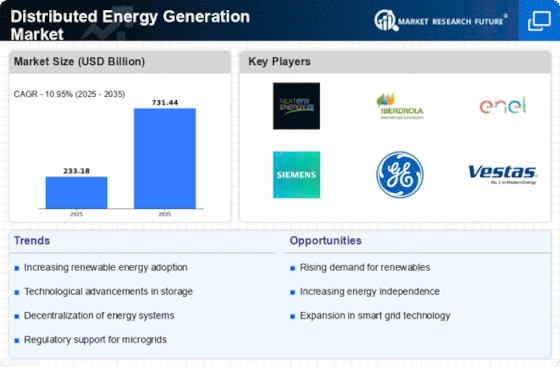

Technological innovations play a pivotal role in shaping the Distributed Energy Generation Market. The emergence of advanced energy storage solutions, such as lithium-ion batteries, has significantly improved the efficiency and reliability of distributed energy systems. Moreover, the integration of smart technologies, including IoT and AI, facilitates real-time monitoring and management of energy resources. These advancements enable consumers to optimize their energy usage and reduce costs. As a result, the market for distributed energy generation technologies is projected to expand, with estimates suggesting a compound annual growth rate of around 15% over the next five years. This technological evolution is crucial for enhancing the overall performance and adoption of distributed energy systems.

Regulatory Support and Incentives

The Distributed Energy Generation Market benefits from a favorable regulatory environment that encourages the adoption of decentralized energy systems. Governments are increasingly implementing policies and incentives to promote renewable energy sources, such as solar and wind. For instance, tax credits, rebates, and feed-in tariffs are designed to lower the financial barriers for consumers and businesses. In many regions, these incentives have led to a marked increase in distributed energy installations, with a reported growth rate of approximately 20% annually. This regulatory support not only enhances the economic viability of distributed energy projects but also aligns with broader sustainability goals, thereby fostering a more resilient energy landscape.

Decentralization of Energy Systems

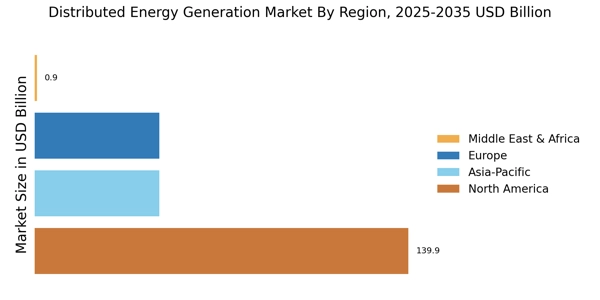

The trend towards decentralization is reshaping the Distributed Energy Generation Market. Traditional centralized energy systems are increasingly being complemented, or even replaced, by decentralized models that empower local communities and consumers. This shift is driven by the desire for energy independence, resilience against outages, and the ability to harness local resources. Decentralized energy systems, such as microgrids and community solar projects, are gaining traction as they offer enhanced reliability and flexibility. Market analyses suggest that the decentralized energy sector could account for over 40% of total energy generation by 2030. This transition not only supports energy security but also fosters local economic development, making it a compelling driver for the distributed energy generation market.

Environmental Concerns and Sustainability Goals

Environmental awareness and the pursuit of sustainability are increasingly influencing the Distributed Energy Generation Market. As climate change concerns escalate, there is a growing emphasis on reducing greenhouse gas emissions and transitioning to cleaner energy sources. Distributed energy generation, particularly from renewable sources, aligns with these sustainability objectives by minimizing reliance on fossil fuels. Many countries have set ambitious targets for carbon neutrality, which necessitates a significant increase in renewable energy capacity. Reports indicate that achieving these targets could require a tripling of renewable energy installations by 2040. This heightened focus on environmental sustainability is likely to drive further investments in distributed energy generation technologies.