Expansion of Industrial Automation

The expansion of industrial automation is a key driver for the IGBT and Super Junction MOSFET Market. As industries increasingly adopt automation technologies to enhance productivity and reduce labor costs, the demand for advanced power electronics is on the rise. IGBTs and Super Junction MOSFETs are essential components in various automation applications, including motor drives and robotics. The industrial automation market is expected to witness substantial growth, with investments in smart manufacturing and Industry 4.0 initiatives driving the need for efficient power management solutions. This growth in automation is likely to create new opportunities for the IGBT and Super Junction MOSFET Market, as manufacturers seek to integrate these technologies into their systems.

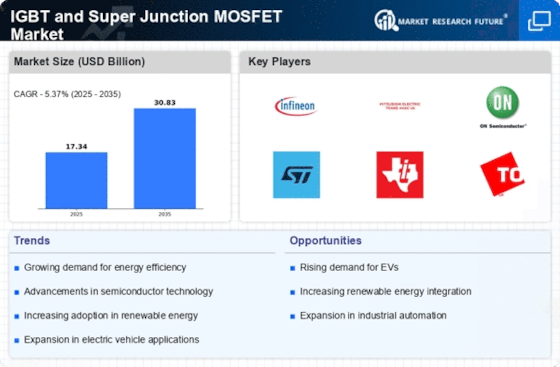

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency across various industries is a significant driver for the IGBT and Super Junction MOSFET Market. As energy costs rise and environmental regulations tighten, businesses are seeking solutions that minimize energy consumption. IGBTs and Super Junction MOSFETs are known for their high efficiency in power conversion applications, making them ideal for use in industrial equipment, HVAC systems, and consumer electronics. The market for energy-efficient technologies is projected to grow, with many industries adopting these solutions to comply with regulatory standards and reduce operational costs. This trend is likely to bolster the demand for IGBT and Super Junction MOSFET Market technologies.

Growth in Electric Vehicle Production

The electric vehicle (EV) sector is experiencing unprecedented growth, which serves as a crucial driver for the IGBT and Super Junction MOSFET Market. With the global push for sustainable transportation, automakers are ramping up production of EVs, necessitating advanced power electronics for efficient energy management. IGBTs and Super Junction MOSFETs play a vital role in the powertrains of electric vehicles, enhancing performance and efficiency. The EV market is anticipated to expand rapidly, with projections indicating that by 2030, electric vehicles could account for a substantial percentage of total vehicle sales. This trend underscores the increasing reliance on IGBT and Super Junction MOSFET Market technologies in the automotive sector.

Increasing Adoption of Renewable Energy Sources

The transition towards renewable energy sources is a pivotal driver for the IGBT and Super Junction MOSFET Market. As nations strive to reduce carbon emissions, the demand for efficient power conversion technologies has surged. IGBTs and Super Junction MOSFETs are integral in solar inverters and wind turbine applications, facilitating the conversion of renewable energy into usable electricity. The market for renewable energy is projected to grow significantly, with investments in solar and wind energy expected to reach trillions of dollars by 2030. This growth directly correlates with the increasing need for advanced semiconductor technologies, thereby propelling the IGBT and Super Junction MOSFET Market forward.

Technological Advancements in Power Electronics

Technological advancements in power electronics are significantly influencing the IGBT and Super Junction MOSFET Market. Innovations in semiconductor materials and manufacturing processes have led to the development of more efficient and reliable devices. These advancements enable higher switching frequencies and improved thermal performance, which are essential for modern applications in industrial automation, renewable energy systems, and electric vehicles. The market is witnessing a shift towards more compact and efficient designs, which is likely to enhance the adoption of IGBTs and Super Junction MOSFETs across various sectors. As technology continues to evolve, the demand for these advanced semiconductor solutions is expected to rise, further driving the market.