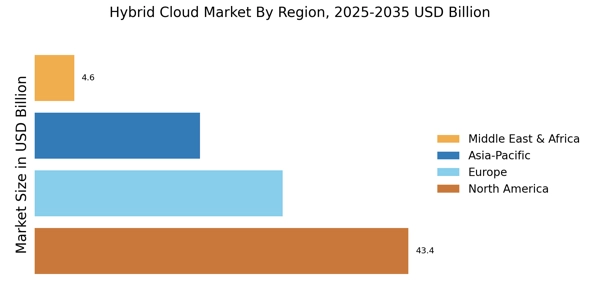

North America : Cloud Innovation Leader

North America is the largest market for hybrid cloud solutions, holding approximately 45% of the global market share. North America accounted for the largest hybrid cloud market share in 2024, driven by strong enterprise adoption and advanced cloud infrastructure. The region's growth is driven by increasing demand for scalable IT infrastructure, regulatory compliance, and the need for enhanced data security. Major players like Amazon Web Services and Microsoft are investing heavily in cloud technologies, further propelling market expansion. The regulatory environment, particularly in the U.S., supports innovation while ensuring data protection and privacy. The United States leads the hybrid cloud market, followed by Canada, which contributes significantly to the overall growth. The competitive landscape is characterized by the presence of key players such as IBM, Oracle, and Google Cloud, all of which are enhancing their service offerings. The focus on digital transformation across various sectors, including healthcare and finance, is driving the adoption of hybrid cloud solutions, making North America a pivotal region in this market.

Europe : Emerging Cloud Ecosystem

Europe is witnessing rapid growth in the hybrid cloud market, accounting for approximately 30% of the global share. The region's expansion is fueled by increasing digitalization, the need for data sovereignty, and stringent regulations like the GDPR. Countries such as Germany and the UK are at the forefront, driving demand for hybrid solutions that comply with local regulations while offering flexibility and scalability. The European market is characterized by a strong emphasis on data protection and privacy, which is shaping cloud adoption trends. Leading countries in Europe include Germany, the UK, and France, where major players like SAP and Oracle are enhancing their hybrid cloud offerings. The competitive landscape is evolving, with local providers also gaining traction. The presence of key players such as Microsoft and AWS further intensifies competition, as they adapt their services to meet regional needs. The European market is becoming a vibrant ecosystem for hybrid cloud solutions, supported by both regulatory frameworks and technological advancements.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a significant player in the hybrid cloud market, holding around 20% of the global share. The region's growth is driven by rapid digital transformation, increasing internet penetration, and a growing number of SMEs adopting cloud solutions. Countries like China and India are leading the charge, with government initiatives promoting cloud adoption and innovation. The competitive landscape is evolving, with both The Hybrid Cloud Market share, supported by favorable regulations and investments in infrastructure. China is the largest market in the region, followed by India, where companies are increasingly leveraging hybrid cloud solutions to enhance operational efficiency. Key players such as Alibaba Cloud and Huawei are expanding their offerings, while local startups are also entering the market. The focus on digital economy initiatives and smart city projects is further propelling the demand for hybrid cloud solutions, making Asia-Pacific a dynamic region for growth in this sector.

Middle East and Africa : Emerging Cloud Frontier

The Middle East and Africa region is gradually emerging in the hybrid cloud market, holding approximately 5% of the global share. The growth is primarily driven by increasing investments in digital infrastructure, government initiatives promoting cloud adoption, and a rising demand for data localization. Countries like the UAE and South Africa are leading the way, with significant investments in technology and innovation. The region's regulatory landscape is evolving, supporting the growth of hybrid cloud solutions while addressing data security concerns. The UAE is the largest market in the region, followed by South Africa, where key players like Microsoft and AWS are expanding their presence. The competitive landscape is characterized by a mix of global and local providers, with a focus on tailored solutions for various industries. The emphasis on smart city projects and digital transformation initiatives is driving the adoption of hybrid cloud solutions, positioning the Middle East and Africa as an emerging frontier in The Hybrid Cloud Market.