Growing Demand for Scalability

The Hybrid Cloud in BFSI Market is witnessing a growing demand for scalability as financial institutions seek to adapt to fluctuating workloads. This demand is driven by the need for banks and insurance companies to manage peak periods, such as end-of-quarter reporting or seasonal spikes in transactions. According to recent data, approximately 70% of BFSI organizations are prioritizing scalable solutions to enhance operational efficiency. The flexibility offered by hybrid cloud solutions allows these institutions to scale resources up or down based on real-time requirements, thereby optimizing costs and improving service delivery. As the financial landscape continues to evolve, the ability to scale operations seamlessly is becoming a critical factor for success in the Hybrid Cloud in BFSI Market.

Enhanced Data Analytics Capabilities

The Hybrid Cloud in BFSI Market is increasingly driven by the need for enhanced data analytics capabilities. Financial institutions are recognizing the importance of data-driven decision-making to remain competitive. Hybrid cloud solutions facilitate the integration of vast amounts of data from various sources, enabling advanced analytics and insights. Approximately 65% of BFSI organizations are investing in analytics tools that leverage hybrid cloud architectures to improve risk management and customer insights. This capability allows institutions to analyze customer behavior, assess credit risk, and tailor financial products more effectively. As the demand for data analytics continues to rise, the hybrid cloud model is likely to play a crucial role in shaping the future of the BFSI sector.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the Hybrid Cloud in BFSI Market, as financial institutions strive to optimize their IT expenditures. By leveraging hybrid cloud solutions, organizations can reduce capital expenses associated with on-premises infrastructure while benefiting from the flexibility of cloud resources. Recent studies indicate that BFSI firms can achieve up to 30% savings in operational costs by adopting hybrid cloud strategies. This cost-effectiveness is particularly appealing in an industry where margins are often tight. Furthermore, hybrid cloud environments enable better resource allocation, allowing institutions to invest more in innovation and customer service rather than maintaining legacy systems. As a result, the focus on cost efficiency is likely to propel the adoption of hybrid cloud solutions in the BFSI sector.

Innovation and Agility in Service Delivery

Innovation and agility in service delivery are critical drivers in the Hybrid Cloud in BFSI Market. Financial institutions are under constant pressure to innovate and deliver new services rapidly to meet changing customer expectations. Hybrid cloud environments provide the agility needed to develop, test, and deploy new applications quickly. Approximately 60% of BFSI organizations report that hybrid cloud solutions have significantly accelerated their time-to-market for new products and services. This agility not only enhances customer satisfaction but also positions institutions to respond effectively to market changes. As the demand for innovative financial solutions grows, the hybrid cloud model is likely to be a key enabler for success in the BFSI sector.

Regulatory Compliance and Security Enhancements

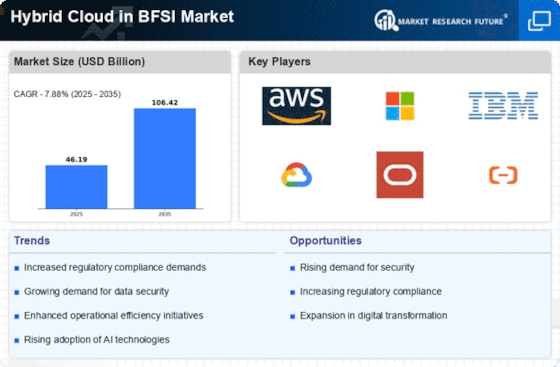

Regulatory compliance and security enhancements are paramount in the Hybrid Cloud in BFSI Market. Financial institutions are subject to stringent regulations regarding data protection and privacy. Hybrid cloud solutions offer the flexibility to store sensitive data on-premises while utilizing the cloud for less sensitive operations. This approach not only aids in compliance with regulations such as GDPR and PCI DSS but also enhances overall security posture. Recent findings suggest that 75% of BFSI organizations are prioritizing hybrid cloud strategies to meet compliance requirements while ensuring robust security measures. As regulatory landscapes evolve, the ability to adapt quickly through hybrid cloud solutions will likely become a competitive advantage for institutions in the BFSI sector.