Rising Demand for Livestock Feed

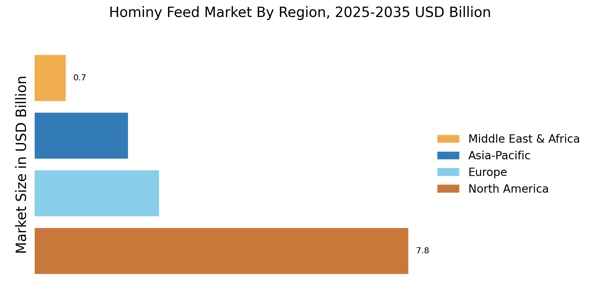

The increasing global population and the corresponding rise in meat consumption are driving the demand for livestock feed, including hominy feed. As livestock producers seek cost-effective and nutritious feed options, hominy feed emerges as a viable alternative due to its high energy content and digestibility. The Hominy Feed Market is witnessing a surge in demand, with projections indicating a growth rate of approximately 5% annually. This trend is further supported by the expansion of the livestock sector, particularly in regions where corn is abundantly produced, thus enhancing the availability of hominy feed. As producers aim to optimize feed efficiency and reduce costs, the adoption of hominy feed is likely to increase, positioning it as a key player in the livestock feed market.

Cost-Effectiveness of Hominy Feed

In the context of rising feed costs, hominy feed presents a cost-effective solution for livestock producers. The Hominy Feed Market is experiencing a shift as farmers seek alternatives to traditional feed sources that may be more expensive. Hominy feed, derived from the processing of corn, is often more affordable than other feed options, allowing producers to maintain profitability while ensuring adequate nutrition for their livestock. This economic advantage is particularly relevant in regions where corn is a staple crop, thus reducing transportation costs and enhancing local availability. As the market continues to evolve, the cost-effectiveness of hominy feed is likely to play a pivotal role in its adoption among livestock producers.

Nutritional Benefits of Hominy Feed

Hominy feed is recognized for its nutritional advantages, particularly its high carbohydrate content and low fiber levels, making it an attractive option for livestock nutrition. The Hominy Feed Market benefits from the growing awareness among farmers regarding the importance of balanced diets for livestock. Research indicates that incorporating hominy feed can enhance weight gain and overall health in animals, which is crucial for producers aiming to maximize productivity. Furthermore, the feed's palatability encourages higher feed intake, contributing to improved growth rates. As livestock producers increasingly prioritize animal health and performance, the demand for hominy feed is expected to rise, reflecting a broader trend towards optimizing livestock nutrition.

Technological Innovations in Feed Production

Advancements in feed processing technology are transforming the Hominy Feed Market. Innovations such as improved milling techniques and enhanced nutrient preservation methods are increasing the efficiency and quality of hominy feed production. These technological developments not only enhance the nutritional profile of hominy feed but also streamline production processes, making it more accessible to livestock producers. As technology continues to evolve, the potential for customized feed formulations tailored to specific livestock needs is likely to emerge. This adaptability could further drive the adoption of hominy feed, as producers seek to optimize feed efficiency and animal performance. The integration of technology in feed production is poised to play a crucial role in shaping the future of the hominy feed market.

Sustainability and Environmental Considerations

The increasing emphasis on sustainable agricultural practices is influencing the Hominy Feed Market. As consumers become more environmentally conscious, livestock producers are under pressure to adopt sustainable feeding practices. Hominy feed, being a byproduct of corn processing, contributes to waste reduction and promotes resource efficiency. This aligns with the broader trend of utilizing byproducts in animal nutrition, thereby minimizing environmental impact. Moreover, the lower carbon footprint associated with hominy feed production compared to traditional feed sources enhances its appeal. As sustainability becomes a key driver in agricultural practices, the demand for hominy feed is expected to grow, reflecting a shift towards more environmentally responsible livestock production.

.png)