Feed Supplements Market Summary

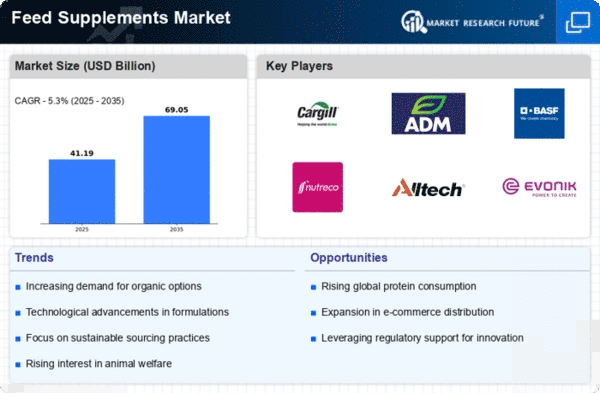

As per MRFR analysis, the Feed Supplements Market was estimated at 39.12 USD Billion in 2024. The Feed Supplements industry is projected to grow from 41.19 USD Billion in 2025 to 69.05 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.3% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Feed Supplements Market is experiencing a dynamic evolution driven by various trends and regional insights.

- There is a notable shift towards natural ingredients in feed supplements, reflecting consumer preferences for healthier animal products.

- Technological advancements in nutrition are enhancing the efficacy of feed supplements, particularly in the livestock segment.

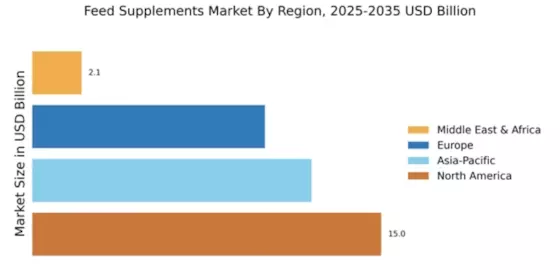

- Regulatory changes and compliance are shaping market dynamics, especially in North America, the largest market for feed supplements.

- The rising demand for animal protein and a focus on animal health and welfare are key drivers propelling growth in both the nutritional supplements and aquaculture segments.

Market Size & Forecast

| 2024 Market Size | 39.12 (USD Billion) |

| 2035 Market Size | 69.05 (USD Billion) |

| CAGR (2025 - 2035) | 5.3% |

Major Players

Cargill (US), Archer Daniels Midland (US), BASF (DE), Nutreco (NL), Alltech (US), Evonik Industries (DE), DSM (NL), Kemin Industries (US), Land O'Lakes (US)