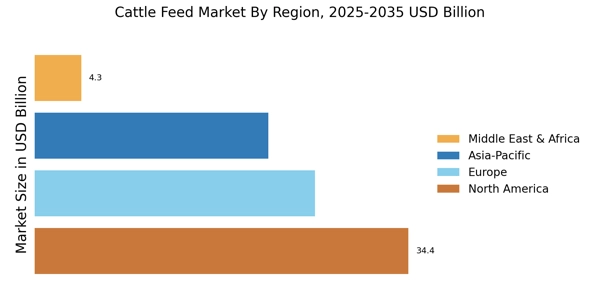

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North America Cattle Feed Market accounted for USD 36.4568 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. Demand for cattle feed is rising as the population grows. The United States consumed 284 million metric tons of animal feed in North America in 2019, of which 64 million metric tons went to feed beef cattle.

The United States is one of the world's largest producers and exporters of cattle feed due to the sizeable size and demand of its livestock industry. The United States contributed 90.7 percent of all feed exports in 2020, according to ITC. The production and consumption of cattle feed are growing yearly in the region, but the region holds a significant portion of the cattle feed industry. Large multinational corporations like Cargill Inc. are common in the region's market of cattle feed, which distinguishes it. Land O' Lakes, and ADM, among others, are well-known in the United States and Canada.

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe’s Cattle Feed Market accounts for the second-largest market share. Germany's 330 feed mills will aid the expansion of the European market. Additionally, pork and cattle consumption accounts for more than 65% of all animal feed consumption in Spain, making them the primary drivers of the country's cattle feed industry. Over the forecast period, free trade agreements in the region for nations in the European Union will positively impact market growth. Further, the Germany Cattle Feed industryheld the largest market share, and the UK market for cattle feed was the fastest-growing market in the European region.

The Asia-Pacific Cattle Feed Market is expected to grow at the fastest CAGR from 2022 to 2030 due to the rise in demand from vegan consumers. The overall expansion of the market for cattle feed is influenced by several important macroeconomic factors, including the rise in social media usage and the increase in per capita income. The demand for meat and dairy products in child nutrition is expected to increase, which will likely lead to significant growth for LAMEA.

The number of millennials in the area has also increased significantly, and they are the biggest consumers of new meat and food products. So, the growing millennial population is expected to present lucrative market opportunities for cattle feed. Moreover, the China Cattle Feed industry held the largest market share, and the India cattle feed industry was the fastest-growing market in the Asia-Pacific region.