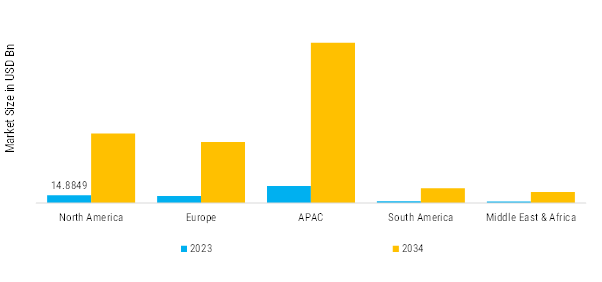

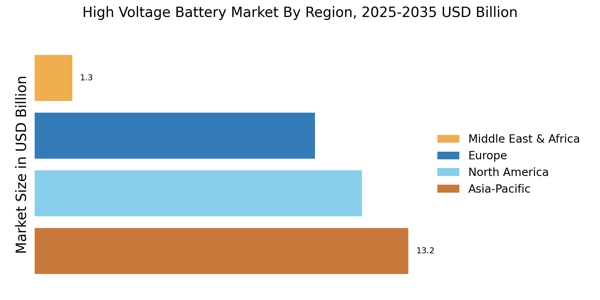

North America: Significant Market with Stable Demand

North America remains a major player in the high voltage battery market, primarily led by the United States and Canada. Rapid adoption of electric vehicles, supported by government incentives such as the Inflation Reduction Act (IRA), is driving demand for high-voltage battery systems. The region benefits from established EV manufacturers like Tesla, which heavily invest in battery technology and innovation. Additionally, growing deployment of grid-scale energy storage and renewable energy integration, including solar and wind, is boosting stationary battery applications. The mature charging infrastructure and skilled workforce contribute to steady adoption. However, supply chain challenges, particularly related to raw material sourcing for lithium, cobalt, and nickel, remain a key concern. Ongoing domestic battery production initiatives and partnerships with global suppliers are expected to stabilize the market and ensure long-term growth.

Europe: Strong Market with Regulatory Influence

Europe holds a significant position in the high voltage battery market, fueled by strict carbon emission regulations and ambitious electrification targets. The region’s focus on sustainable transportation, coupled with bans on future sales of internal combustion engine vehicles in countries like Norway and Germany, is accelerating EV adoption. Heavy investments in battery gigafactories across Germany, France, and the UK are strengthening manufacturing capabilities, while collaborations between automakers and technology providers are enhancing battery efficiency and safety. Europe is also investing heavily in renewable energy storage infrastructure, enabling grid balancing and stable integration of intermittent energy sources like solar and wind. Despite higher production costs and regulatory compliance requirements, the region’s proactive approach to technology innovation and sustainability positions it as a leader in advanced battery solutions.

Asia-Pacific: Largest Market with High Potential

Asia-Pacific dominates the High Voltage Battery Market, both in terms of production and consumption. China, South Korea, and Japan are key contributors, with China leading EV adoption, battery manufacturing, and raw material processing. Companies like CATL, BYD, and LG Energy Solution drive technological innovation and scale production. Government incentives, strong supply chains, and cost advantages further support growth in both automotive and stationary applications. High voltage batteries are widely used in electric vehicles, energy storage systems, telecom backup power, and smart grid infrastructure. Rapid urbanization and industrialization are increasing energy demand, while advancements in next-generation battery chemistries, such as NMC and solid-state technologies, are expected to accelerate adoption. The combination of large market size, manufacturing capacity, and government support makes Asia-Pacific the most influential region globally.

South America: Emerging Market with Gradual Adoption

South America is an emerging market for high voltage batteries, with adoption driven by growing awareness of electric mobility and renewable energy opportunities. Countries such as Brazil, Chile, and Argentina are exploring high-voltage battery systems for electric buses, urban transport, and solar-plus-storage solutions in off-grid areas. Chile plays a strategic role due to its vast lithium reserves, critical for battery production. While the market is still in its early stages, international collaborations and investments are helping build local manufacturing and supply chain capabilities. Government policies supporting clean energy and the electrification of public transport are expected to accelerate growth. Challenges such as infrastructure limitations and higher costs remain, but long-term prospects for the region are promising.

Middle East & Africa: Small Market with Growth Potential

The Middle East & Africa currently hold a smaller share of the High Voltage Battery Market but offer significant growth potential. Countries such as the UAE and Saudi Arabia are investing heavily in renewable energy projects, smart cities, and EV initiatives, where high-voltage batteries play a key role in grid storage and solar energy integration. In Africa, demand is increasing for off-grid energy solutions, particularly in rural areas where electricity access is limited. While adoption is currently constrained by infrastructure and investment challenges, the region’s focus on sustainable development, energy independence, and industrialization is expected to open new opportunities. International partnerships and technology transfer initiatives are likely to accelerate market expansion in both industrial and residential sectors.

.png)