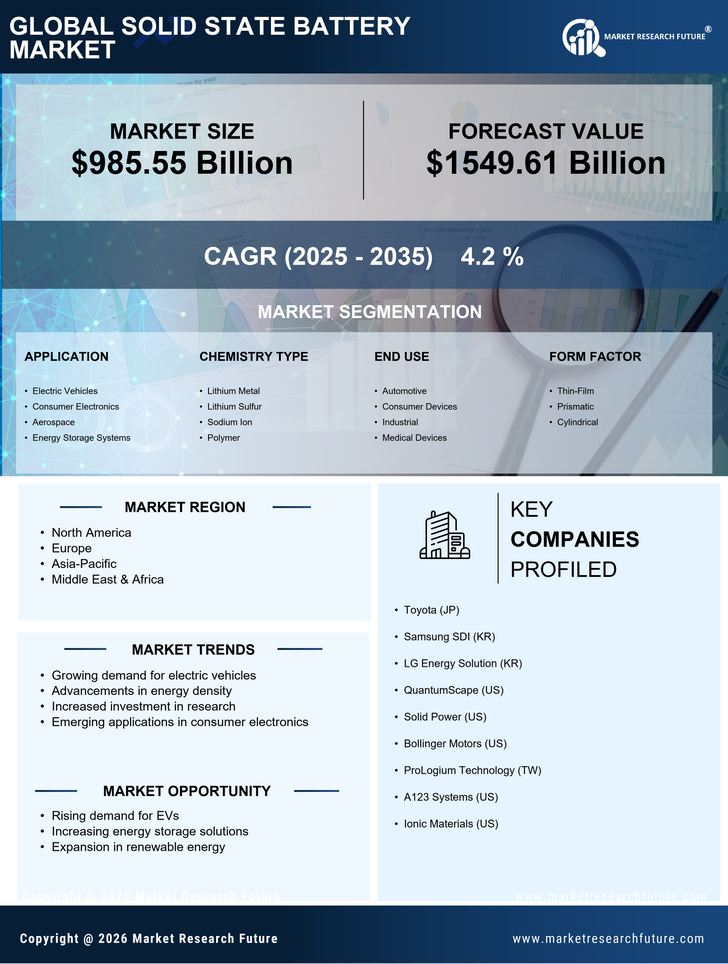

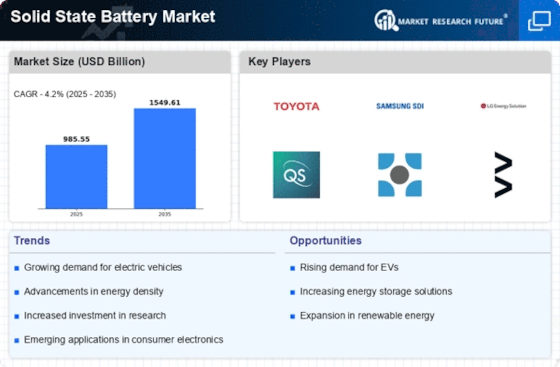

The Solid State Battery Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for high-performance energy storage solutions across various sectors, including automotive and consumer electronics.

Major solid state battery companies such as Toyota (Japan), Samsung SDI (South Korea), and QuantumScape (United States) are at the forefront of this market, each adopting distinct strategies to enhance their market positioning. Toyota (Japan) has been focusing on innovation, particularly in developing solid-state battery technology for electric vehicles, which is expected to significantly improve energy density and safety. Meanwhile, Samsung SDI (South Korea) is leveraging its extensive research capabilities to advance solid-state battery production, aiming to establish a competitive edge through technological superiority. QuantumScape (United States) is also making strides in this arena, emphasizing partnerships with automotive manufacturers to accelerate the commercialization of its solid-state battery solutions.

In terms of business tactics, solid state batteries companies are increasingly localizing manufacturing to mitigate supply chain disruptions and enhance responsiveness to market demands. The Solid State Battery Market appears moderately fragmented, with a mix of established solid state battery companies and emerging startups. This structure allows for a diverse range of innovations and competitive strategies, as solid state battery manufacturers vie for market share and technological leadership.

In August 2025, Toyota (Japan) announced a strategic partnership with a leading semiconductor manufacturer to enhance the integration of advanced materials in its solid-state batteries. This collaboration is poised to streamline production processes and improve battery performance, reflecting Toyota's commitment to maintaining its leadership in the electric vehicle sector. The strategic importance of this partnership lies in its potential to accelerate the development timeline for next-generation batteries, thereby positioning Toyota favorably against competitors.

In September 2025, Samsung SDI (South Korea), which is one of the important solid state battery company, unveiled a new solid-state battery prototype that reportedly offers a 30% increase in energy density compared to its previous models. This solid state battery development underscores Samsung's focus on innovation and its intent to capture a larger share of the electric vehicle market. The introduction of this prototype is likely to enhance Samsung's competitive stance, as it aligns with the growing consumer demand for longer-lasting and more efficient battery solutions.

In October 2025, QuantumScape (United States) revealed plans to expand its manufacturing capabilities by establishing a new facility dedicated to solid-state battery production. This move is indicative of QuantumScape's strategy to scale operations and meet the anticipated surge in demand for electric vehicles. The establishment of this facility is expected to significantly enhance production capacity, thereby solidifying QuantumScape's position as a key player in the Solid State Battery Market.

As of October 2025, the competitive trends within the Solid State Battery Market are increasingly influenced by digitalization, sustainability, and the integration of artificial intelligence in manufacturing processes. Strategic alliances are becoming more prevalent, as solid state batteries manufacturers recognize the value of collaboration in driving innovation and enhancing supply chain resilience. Looking ahead, it is likely that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on technological advancements, innovation, and reliability in supply chains. This transition may redefine the competitive landscape, as companies strive to offer superior products that meet the evolving needs of consumers.