Rising Demand for Electricity

The increasing demand for electricity across various sectors is a primary driver for the High Voltage System Market. As urbanization and industrialization continue to expand, the need for reliable and efficient power transmission becomes paramount. According to recent data, electricity consumption is projected to rise by approximately 2.5% annually, necessitating the development of high voltage systems to meet this demand. This trend is particularly evident in emerging economies, where rapid population growth and economic development are driving the need for enhanced electrical infrastructure. Consequently, the High Voltage System Market is likely to experience substantial growth as utilities and energy providers invest in upgrading their transmission networks to accommodate this rising demand.

Growing Focus on Energy Efficiency

The emphasis on energy efficiency is becoming increasingly prominent within the High Voltage System Market. As organizations and governments strive to reduce energy consumption and minimize operational costs, the demand for high voltage systems that optimize energy transmission is rising. Technologies that enhance the efficiency of power delivery, such as high voltage direct current (HVDC) systems, are gaining traction. These systems are known for their ability to transmit electricity over long distances with minimal losses. The global push for energy efficiency is likely to drive investments in high voltage technologies, thereby contributing to the expansion of the High Voltage System Market.

Government Initiatives and Policies

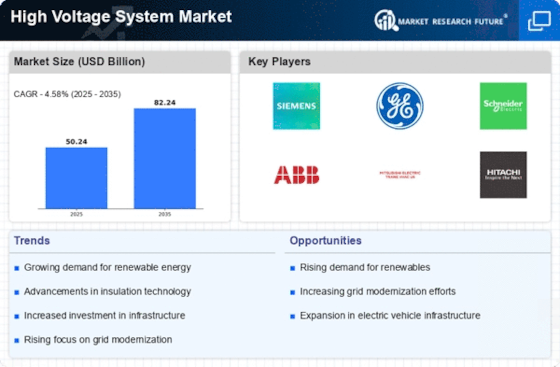

Government initiatives and policies aimed at enhancing energy infrastructure play a crucial role in shaping the High Voltage System Market. Many countries are implementing regulations and incentives to promote the development of high voltage transmission systems. For instance, policies that support renewable energy integration and reduce carbon emissions are driving investments in high voltage infrastructure. In several regions, governments are allocating substantial budgets for upgrading existing power grids and constructing new transmission lines. This regulatory support not only fosters market growth but also encourages private sector participation in the High Voltage System Market, leading to increased competition and innovation.

Investment in Smart Grid Technologies

The transition towards smart grid technologies is significantly influencing the High Voltage System Market. Smart grids facilitate improved energy management, enhance reliability, and enable the integration of renewable energy sources. Investments in smart grid infrastructure are expected to reach billions of dollars in the coming years, driven by the need for modernization and efficiency. The implementation of advanced metering infrastructure, automated control systems, and real-time monitoring capabilities are essential components of this transition. As utilities adopt these technologies, the demand for high voltage systems that can support smart grid functionalities is likely to increase, thereby propelling the growth of the High Voltage System Market.

Expansion of Electric Vehicle Infrastructure

The rapid expansion of electric vehicle (EV) infrastructure is emerging as a significant driver for the High Voltage System Market. As the adoption of electric vehicles accelerates, the demand for robust charging networks and high voltage systems to support these infrastructures is increasing. The need for high-capacity charging stations, which often require high voltage connections, is becoming critical. Furthermore, the integration of EVs into the power grid presents opportunities for innovative high voltage solutions that facilitate vehicle-to-grid technologies. This trend is likely to stimulate investments in high voltage systems, thereby enhancing the overall growth of the High Voltage System Market.