Rising Labor Costs in Healthcare

Labor costs in the healthcare sector continue to rise, prompting facilities to seek innovative solutions to manage expenses. The Healthcare Mobile Robot Market is positioned to benefit from this trend, as mobile robots can perform repetitive tasks, thereby allowing human staff to focus on more complex patient care activities. The integration of mobile robots can lead to significant cost savings, with estimates suggesting that hospitals could reduce labor costs by up to 30% through automation. This economic incentive is likely to drive further investment in mobile robotics, as healthcare providers look to balance quality care with financial sustainability.

Growing Emphasis on Infection Control

Infection control remains a critical concern within healthcare settings, particularly in hospitals and long-term care facilities. The Healthcare Mobile Robot Market is responding to this need by offering robots designed for disinfection and sanitation. These robots utilize advanced technologies such as ultraviolet light and electrostatic spraying to effectively eliminate pathogens. As healthcare facilities increasingly prioritize hygiene, the demand for mobile robots capable of maintaining sterile environments is expected to rise. Market analysts predict that the segment for disinfection robots will account for a significant share of the overall healthcare mobile robot market, reflecting the industry's commitment to patient safety.

Technological Advancements in Robotics

Technological advancements play a pivotal role in shaping the Healthcare Mobile Robot Market. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of mobile robots, making them more efficient and versatile. These advancements enable robots to navigate complex environments, interact with patients, and perform a variety of tasks autonomously. As technology continues to evolve, the potential applications for mobile robots in healthcare are expanding, which may lead to increased adoption rates. The integration of cutting-edge technologies is likely to drive market growth, as healthcare providers seek to leverage these tools to improve patient outcomes.

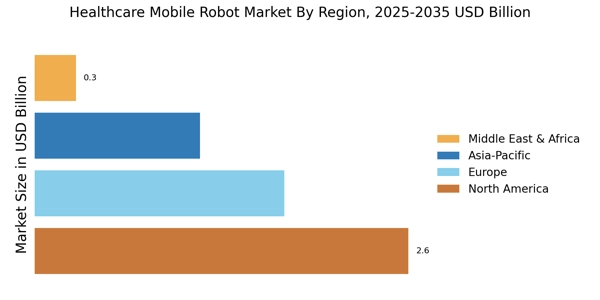

Aging Population and Increased Chronic Diseases

The aging population and the rising prevalence of chronic diseases are significant factors influencing the Healthcare Mobile Robot Market. As the demographic landscape shifts, healthcare systems are facing increased pressure to provide care for a growing number of elderly patients. Mobile robots can assist in managing this demand by facilitating tasks such as medication management and patient monitoring. The market is expected to see a substantial increase in demand for robots that cater specifically to the needs of elderly patients. This demographic trend suggests a long-term growth trajectory for the healthcare mobile robot market, as providers seek innovative solutions to address the challenges posed by an aging society.

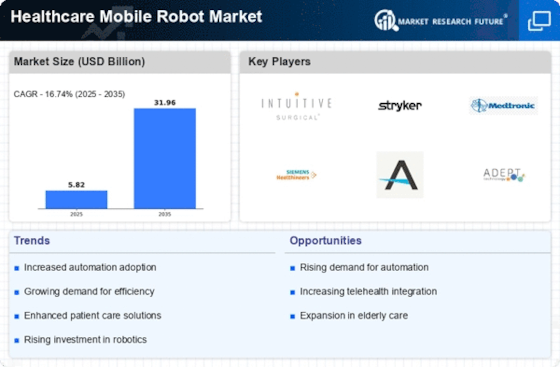

Increased Demand for Efficient Healthcare Delivery

The Healthcare Mobile Robot Market experiences a notable surge in demand for efficient healthcare delivery systems. As healthcare facilities strive to enhance operational efficiency, mobile robots are increasingly deployed for tasks such as medication delivery, patient transport, and sanitation. This trend is driven by the need to reduce human error and improve service speed. According to recent estimates, the market for healthcare mobile robots is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth reflects a broader shift towards automation in healthcare, where mobile robots are seen as essential tools for optimizing workflows and enhancing patient care.