Rising Awareness of Mental Health

The growing awareness of mental health issues is emerging as a vital driver for the Healthcare Assistive Robot Market. As societies become more cognizant of the importance of mental well-being, there is an increasing demand for solutions that can provide emotional support and companionship. Healthcare assistive robots are being designed to engage with patients in meaningful ways, potentially reducing feelings of loneliness and anxiety. The mental health technology market is projected to reach USD 4 billion by 2027, indicating a robust interest in innovative solutions. This trend highlights the potential for assistive robots to address not only physical health needs but also emotional and psychological well-being.

Growing Focus on Patient-Centric Care

The shift towards patient-centric care is significantly influencing the Healthcare Assistive Robot Market. Healthcare providers are increasingly prioritizing personalized care approaches that cater to individual patient needs. Assistive robots can play a pivotal role in this paradigm shift by offering tailored support and enhancing patient engagement. The market for patient-centric solutions is expected to grow at a compound annual growth rate of 15% over the next five years. This trend suggests that healthcare organizations are recognizing the value of integrating technology to improve patient experiences and outcomes, thereby driving demand for assistive robots.

Technological Advancements in Robotics

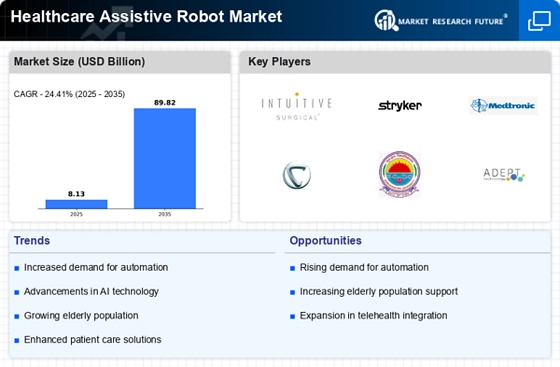

Technological advancements play a crucial role in propelling the Healthcare Assistive Robot Market forward. Innovations in artificial intelligence, machine learning, and sensor technology have significantly enhanced the capabilities of assistive robots. These advancements enable robots to perform complex tasks, such as real-time health monitoring and personalized care, which were previously unattainable. The integration of advanced robotics into healthcare settings is expected to grow, with the market projected to reach USD 12 billion by 2026. This growth is indicative of the increasing reliance on technology to improve patient outcomes and streamline healthcare processes, thereby creating a favorable environment for the adoption of assistive robots.

Rising Demand for Elderly Care Solutions

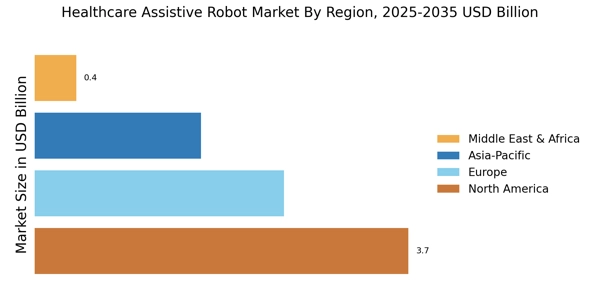

The increasing aging population is a primary driver for the Healthcare Assistive Robot Market. As the number of elderly individuals rises, there is a growing need for innovative solutions that can assist in daily activities and enhance the quality of life. According to recent estimates, the elderly population is projected to reach 1.5 billion by 2050, which underscores the urgency for effective care solutions. Healthcare assistive robots can provide companionship, monitor health conditions, and assist with mobility, thereby alleviating the burden on caregivers. This trend indicates a substantial market opportunity for developers and manufacturers of assistive robots, as they seek to meet the diverse needs of this demographic.

Increased Investment in Healthcare Robotics

Investment in healthcare robotics is witnessing a notable surge, which is a key driver for the Healthcare Assistive Robot Market. Governments and private entities are increasingly allocating funds to research and development in robotics, aiming to enhance healthcare delivery systems. For instance, funding for robotic research has increased by over 30% in the last five years, reflecting a commitment to innovation in healthcare. This influx of capital not only accelerates the development of new technologies but also fosters collaboration between tech companies and healthcare providers. As a result, the market is likely to expand, with more sophisticated and effective assistive robots entering the market.