Increased Focus on Sustainability

Sustainability has become a pivotal concern within the Hand Wrapper Market. As consumers and businesses alike prioritize eco-friendly practices, the demand for sustainable packaging solutions is on the rise. Companies are increasingly seeking hand wrapping equipment that utilizes recyclable materials and minimizes waste. This shift is not merely a trend but a fundamental change in consumer behavior, influencing purchasing decisions across various sectors. Recent statistics indicate that approximately 70% of consumers are willing to pay more for sustainable products, which has prompted manufacturers to innovate and adapt their offerings. The Hand Wrapper Market is thus witnessing a transformation, with a growing emphasis on sustainability driving product development and market expansion.

Growth in E-commerce and Retail Sectors

The Hand Wrapper Market is benefiting from the rapid growth of the e-commerce and retail sectors. As online shopping continues to gain traction, the demand for efficient packaging solutions has escalated. E-commerce businesses require reliable hand wrapping equipment to ensure that products are securely packaged for shipping. This trend is reflected in market data, which shows that the e-commerce sector is expected to grow by over 20% annually in the coming years. As a result, the Hand Wrapper Market is poised for expansion, with manufacturers developing specialized solutions tailored to the unique needs of e-commerce and retail businesses. This growth presents significant opportunities for innovation and market penetration.

Customization and Branding Opportunities

The Hand Wrapper Market is witnessing a surge in demand for customization and branding options. Businesses are increasingly recognizing the importance of packaging in brand identity and customer engagement. Customizable hand wrapping solutions allow companies to incorporate their branding elements, such as logos and colors, directly into the packaging process. This trend is particularly prevalent in the retail and e-commerce sectors, where unique packaging can enhance the customer experience. Recent surveys indicate that 60% of consumers are more likely to purchase products with distinctive packaging. Consequently, manufacturers are focusing on developing hand wrapping equipment that supports customization, thereby creating new opportunities for businesses to differentiate themselves in a competitive market.

Rising Demand for Efficient Packaging Solutions

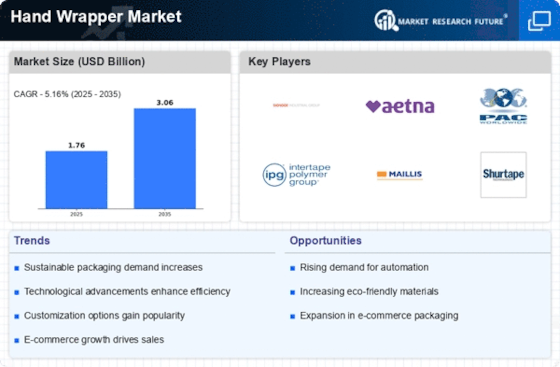

The Hand Wrapper Market is experiencing a notable increase in demand for efficient packaging solutions. As businesses strive to enhance operational efficiency, the need for reliable hand wrapping equipment has surged. This trend is particularly evident in sectors such as food and beverage, where the requirement for quick and effective packaging is paramount. According to recent data, the hand wrapper market is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This growth is driven by the necessity for businesses to streamline their packaging processes while ensuring product safety and integrity. Consequently, manufacturers are focusing on developing innovative hand wrapping solutions that cater to diverse industry needs, thereby propelling the Hand Wrapper Market forward.

Technological Innovations in Hand Wrapping Equipment

Technological advancements are significantly shaping the Hand Wrapper Market. The integration of automation and smart technology into hand wrapping equipment is enhancing efficiency and precision. Innovations such as adjustable speed settings, user-friendly interfaces, and enhanced safety features are becoming standard in modern hand wrappers. These advancements not only improve the user experience but also increase productivity, allowing businesses to meet growing demands. Market analysis suggests that the adoption of technologically advanced hand wrapping solutions could lead to a 15% increase in operational efficiency for companies. As a result, manufacturers are investing in research and development to create cutting-edge hand wrapping solutions that align with the evolving needs of the market.