Advancements in Treatment Modalities

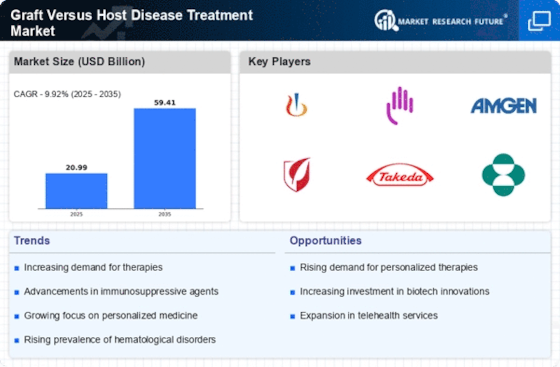

Innovations in treatment modalities are significantly influencing the Graft Versus Host Disease Treatment Market. Recent advancements in immunosuppressive therapies, such as the introduction of novel agents and biologics, have shown promise in improving patient outcomes. For instance, the use of monoclonal antibodies and targeted therapies has been associated with reduced incidence and severity of GVHD. The market is witnessing a shift towards personalized treatment approaches, which are tailored to individual patient profiles. This trend is expected to enhance the efficacy of treatments and improve overall survival rates. Consequently, the Graft Versus Host Disease Treatment Market is likely to benefit from these advancements, as healthcare providers increasingly adopt innovative therapies to manage GVHD.

Rising Awareness and Education Initiatives

The Graft Versus Host Disease Treatment Market is benefiting from rising awareness and education initiatives aimed at both healthcare professionals and patients. Increased understanding of GVHD and its management is crucial for improving treatment outcomes. Various organizations and institutions are actively promoting educational programs, workshops, and seminars to disseminate knowledge about GVHD. This heightened awareness is likely to lead to earlier diagnosis and timely intervention, which are essential for effective treatment. As healthcare providers become more informed about the latest treatment options, the adoption of therapies within the Graft Versus Host Disease Treatment Market is expected to rise, further driving market growth.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is emerging as a key driver in the Graft Versus Host Disease Treatment Market. Regulatory agencies are increasingly recognizing the need for expedited approval processes for novel treatments that address unmet medical needs in GVHD management. Initiatives such as breakthrough therapy designations and fast-track approvals are facilitating quicker access to new therapies for patients. This supportive regulatory environment encourages pharmaceutical companies to invest in the development of innovative solutions for GVHD. As a result, the Graft Versus Host Disease Treatment Market is likely to witness a proliferation of new treatment options, enhancing the overall landscape of GVHD management.

Growing Investment in Research and Development

The Graft Versus Host Disease Treatment Market is experiencing a surge in investment directed towards research and development. Pharmaceutical companies and biotechnology firms are increasingly allocating resources to discover and develop new therapeutic agents for GVHD. This trend is driven by the recognition of unmet medical needs and the potential for lucrative returns on investment. According to industry reports, R&D spending in the field of hematology has seen a notable increase, with several clinical trials underway to evaluate new treatment options. This influx of investment is expected to accelerate the pace of innovation, leading to the introduction of more effective therapies in the Graft Versus Host Disease Treatment Market.

Increasing Incidence of Graft Versus Host Disease

The rising incidence of Graft Versus Host Disease (GVHD) is a primary driver for the Graft Versus Host Disease Treatment Market. As more patients undergo hematopoietic stem cell transplants, the likelihood of developing GVHD increases. Reports indicate that approximately 30 to 50% of allogeneic transplant recipients experience some form of GVHD. This growing patient population necessitates the development and availability of effective treatment options, thereby propelling market growth. Furthermore, the increasing awareness among healthcare professionals regarding the management of GVHD is likely to enhance treatment adoption rates. As a result, the Graft Versus Host Disease Treatment Market is expected to expand significantly to meet the needs of this rising patient demographic.