Gold Mining Market Summary

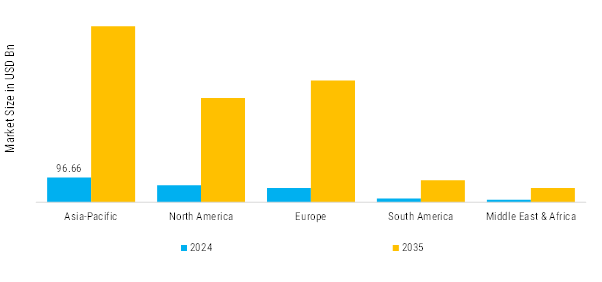

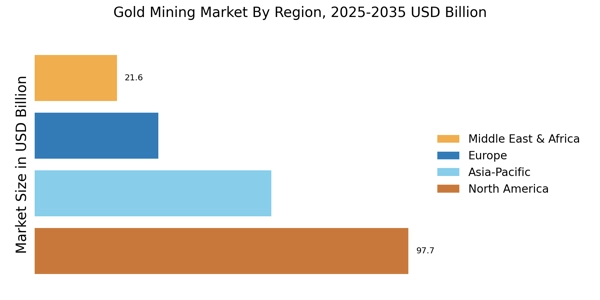

As per Market Research Future analysis, the Global Gold Mining Market Size Was Valued at USD 249.33 Billion In 2024. The Global Gold Mining Industry Is Projected to grow from USD 255.70 Billion in 2025 to USD 379.41 Billion by 2035, Exhibiting A Compound Annual Growth Rate (CAGR) of 4.0% during the Forecast Period (2025 - 2035).

Key Market Trends & Highlights

The Gold Mining Market is the process of extracting gold from the earth through various methods, including placer mining, hard rock mining, by-product recovery, and refining from ore.

- The market encompasses a wide range of activities from geological exploration and feasibility studies to drilling, excavation market.

- Growing focus on preventive processing, and smelting Are Driving the Global Gold Mining Markets.

- Integration of smart features and eco-friendly designs is gaining traction, with rechargeable models leading the market while manual options remain niche.

Market Size & Forecast

| 2024 Market Size | 249.33 (USD Billion) |

| 2035 Market Size | 379.41 (USD Billion) |

| CAGR (2025 - 2035) | 4.0% |

Major Players

Gold Fields Limited, Agnico eagle mines ltd, Barrick Mining Corporation, Polyus (PJSC Polyus), Newmont Mining Corporation, Kinross Gold Corporation, AngloGold Ashanti Ltd, Evolution Mining Ltd, Northern Star Resources Ltd, Harmony Gold Mining Company Ltd, And Others.