Rising Demand for Animal Feed

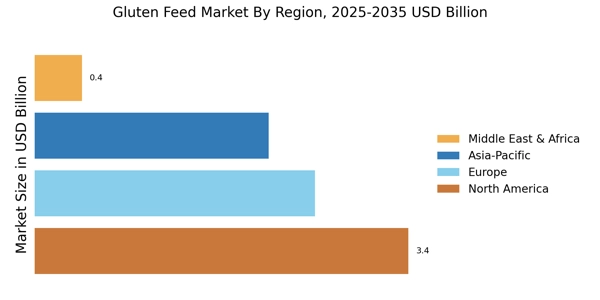

The increasing global population and the corresponding rise in meat consumption are driving the demand for animal feed, including gluten feed. As livestock producers seek cost-effective and nutritious feed options, gluten feed emerges as a viable alternative. The Gluten Feed Market is witnessing a surge in demand, particularly in regions with high livestock production. For instance, the feed industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is indicative of the increasing reliance on gluten feed as a protein source, which is essential for enhancing livestock productivity and overall health.

Cost-Effectiveness of Gluten Feed

The economic advantages associated with gluten feed are becoming increasingly apparent to livestock producers. Gluten feed is often less expensive than traditional feed ingredients, making it an attractive option for farmers looking to optimize their feed costs. The Gluten Feed Market benefits from this trend, as producers are more inclined to incorporate gluten feed into their rations. With feed costs representing a significant portion of livestock production expenses, the cost-effectiveness of gluten feed can lead to improved profit margins for farmers. This financial incentive is likely to drive further adoption of gluten feed in various livestock sectors.

Nutritional Benefits of Gluten Feed

Gluten feed is recognized for its high protein content and essential amino acids, which are crucial for animal growth and development. The Gluten Feed Market is capitalizing on these nutritional benefits, as livestock producers increasingly prioritize feed that supports optimal health and productivity. Research indicates that gluten feed can enhance weight gain and feed efficiency in ruminants and non-ruminants alike. As awareness of animal nutrition continues to grow, the demand for gluten feed is expected to rise, reflecting a broader trend towards healthier livestock diets and improved animal welfare.

Technological Innovations in Feed Production

Advancements in feed processing technologies are enhancing the quality and availability of gluten feed. The Gluten Feed Market is benefiting from innovations that improve the nutritional profile and digestibility of gluten feed products. Techniques such as enzymatic treatment and fermentation are being employed to optimize the feed's nutritional value. These technological improvements not only make gluten feed more appealing to livestock producers but also support the industry's growth by ensuring a consistent supply of high-quality feed. As technology continues to evolve, the potential for gluten feed to play a pivotal role in animal nutrition appears promising.

Sustainability and Environmental Considerations

The push for sustainable agricultural practices is influencing the Gluten Feed Market significantly. Gluten feed, often derived from by-products of the grain processing industry, represents a more sustainable feed option compared to conventional feeds. By utilizing these by-products, the industry contributes to waste reduction and resource efficiency. Furthermore, the lower carbon footprint associated with gluten feed production aligns with the growing consumer demand for environmentally friendly products. As sustainability becomes a key focus for livestock producers, the adoption of gluten feed is likely to increase, reflecting a shift towards more responsible farming practices.