Growing Health Consciousness

The increasing awareness of health and wellness among the German population appears to be a primary driver for the vitamin supplements market. As individuals become more informed about nutrition and its impact on overall health, the demand for vitamin supplements is likely to rise. Recent surveys indicate that approximately 60% of Germans actively seek ways to improve their health through dietary supplements. This trend is further supported by the aging population, which often requires additional nutritional support. Consequently, the vitamin supplements market is experiencing a notable shift towards products that cater to specific health needs, such as immune support and bone health.

Rise of E-commerce Platforms

The expansion of e-commerce platforms in Germany is significantly influencing the vitamin supplements market. With the convenience of online shopping, consumers are increasingly turning to digital channels to purchase their supplements. Data suggests that online sales of dietary supplements have surged by over 30% in recent years, reflecting a shift in consumer behavior. This trend is particularly pronounced among younger demographics who prefer the ease of online transactions. As a result, the vitamin supplements market is adapting to this change by enhancing online presence and offering exclusive online products, thereby reaching a broader audience.

Focus on Preventive Healthcare

The shift towards preventive healthcare in Germany is emerging as a crucial driver for the vitamin supplements market. As healthcare costs continue to rise, both consumers and healthcare providers are increasingly recognizing the value of preventive measures. This trend is reflected in the growing sales of supplements aimed at preventing chronic diseases, with a reported increase of 25% in sales of multivitamins and minerals. The vitamin supplements market is likely to benefit from this focus, as consumers seek products that support long-term health and wellness, thereby driving demand for preventive nutritional solutions.

Influence of Social Media and Influencers

The role of social media and influencers in shaping consumer preferences is becoming increasingly evident in the vitamin supplements market. Platforms such as Instagram and YouTube are inundated with health and wellness content, often featuring endorsements from popular influencers. This trend appears to resonate particularly well with younger consumers, who are more likely to trust recommendations from social media figures. As a result, the vitamin supplements market is witnessing a surge in brand visibility and consumer engagement, with companies investing in influencer partnerships to enhance their market presence and appeal to a broader audience.

Regulatory Support for Nutritional Products

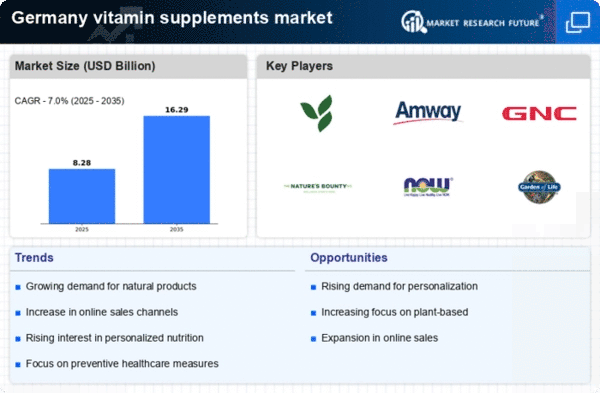

The regulatory environment in Germany is becoming increasingly supportive of the vitamin supplements market. The German Federal Institute for Risk Assessment (BfR) has established guidelines that promote the safe use of dietary supplements, which may enhance consumer confidence. This regulatory clarity is likely to encourage manufacturers to innovate and expand their product lines. Furthermore, the market is projected to grow at a CAGR of 5% over the next five years, driven by the introduction of new formulations and compliance with safety standards. Thus, the vitamin supplements market is poised for growth as regulations facilitate market entry and product development.