Innovations in Product Formulations

Innovations in product formulations are driving growth in the Vitamin Supplements Market. Companies are increasingly investing in research and development to create advanced formulations that enhance the bioavailability and effectiveness of vitamins. This includes the development of new delivery systems, such as gummies and liquid forms, which appeal to a broader consumer base. In 2023, it was reported that innovative product formats accounted for nearly 20% of total vitamin supplement sales. As consumers seek more convenient and palatable options, the trend towards innovative formulations is likely to continue, fostering competition and growth within the industry.

Aging Population and Health Concerns

The demographic shift towards an aging population is significantly impacting the Vitamin Supplements Market. As the global population ages, there is an increasing prevalence of health concerns associated with aging, such as osteoporosis and cardiovascular diseases. This demographic trend is driving the demand for vitamin supplements that cater specifically to the needs of older adults. In 2023, it was estimated that the market for vitamins targeting seniors accounted for approximately 30% of total sales in the industry. This growing segment is likely to expand further as the population continues to age, creating opportunities for companies to develop specialized products that address the unique health challenges faced by older consumers.

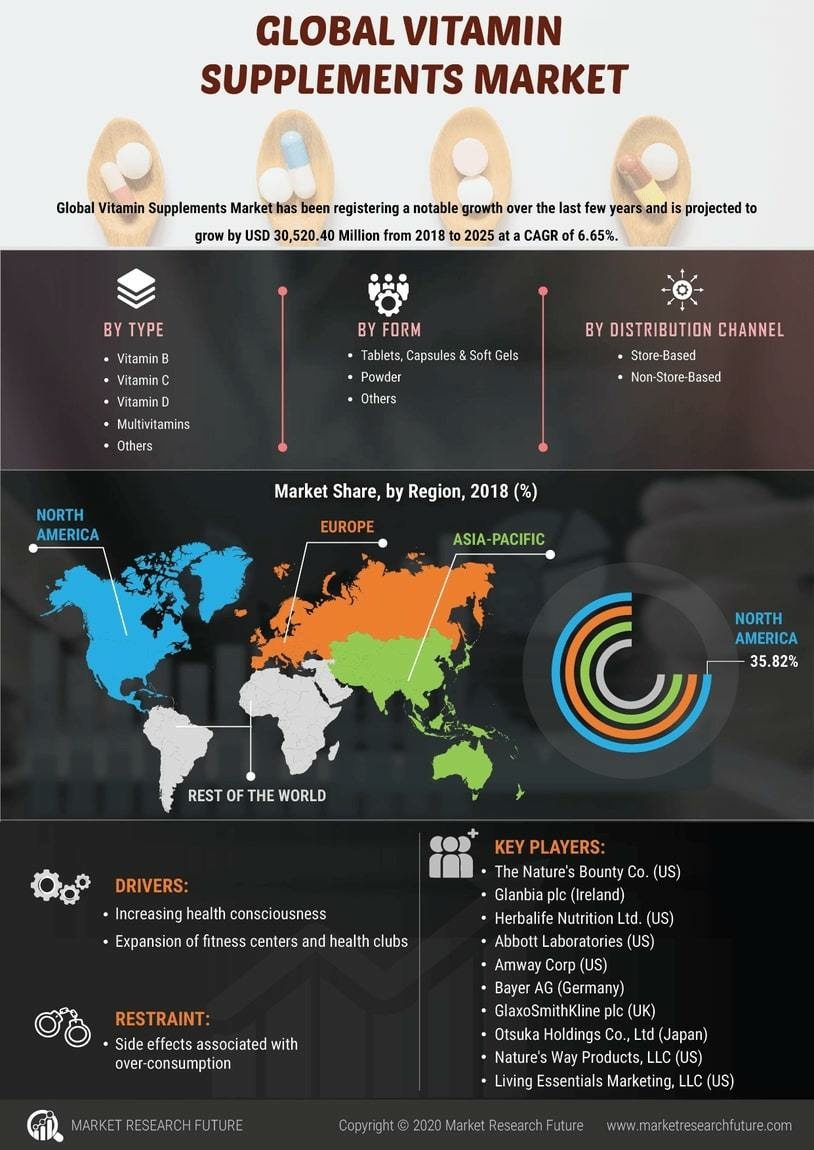

Growing Awareness of Nutritional Health

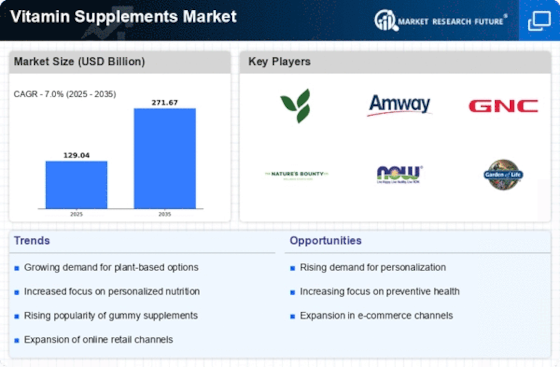

The increasing awareness of nutritional health among consumers appears to be a pivotal driver in the Vitamin Supplements Market. As individuals become more informed about the benefits of vitamins and minerals, there is a noticeable shift towards preventive healthcare. This trend is reflected in the rising sales of vitamin supplements, which reached an estimated value of 50 billion dollars in 2023. Consumers are actively seeking ways to enhance their overall well-being, leading to a surge in demand for various vitamin formulations. This heightened awareness is likely to continue influencing purchasing decisions, as individuals prioritize their health and seek products that support their nutritional needs.

Rise of E-commerce and Online Retailing

The rise of e-commerce and online retailing is transforming the Vitamin Supplements Market. With the convenience of online shopping, consumers are increasingly turning to digital platforms to purchase their vitamin supplements. This shift is supported by data indicating that online sales of dietary supplements grew by over 25% in 2023. E-commerce provides consumers with access to a wider range of products, competitive pricing, and the ability to compare brands easily. As more consumers embrace online shopping, companies in the vitamin supplements sector are likely to invest in digital marketing strategies to enhance their online presence and reach a broader audience.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is reshaping the Vitamin Supplements Market. Consumers are increasingly recognizing the importance of maintaining health and preventing illness through proactive measures, including the use of vitamin supplements. This trend is evident in the rising sales of multivitamins and specific nutrient supplements, which have shown a compound annual growth rate of approximately 8% from 2020 to 2023. As healthcare systems worldwide shift towards preventive care models, the demand for vitamin supplements is expected to rise, as individuals seek to bolster their immune systems and overall health.