Growing Patient Awareness

Growing patient awareness regarding treatment options is a significant driver for the pd l1-inhibitors market. In Germany, patients are increasingly informed about the benefits of immunotherapy, including pd l1-inhibitors, through various channels such as social media, patient advocacy groups, and healthcare providers. This heightened awareness leads to greater demand for these therapies, as patients actively seek out information and advocate for their inclusion in treatment plans. Moreover, educational campaigns aimed at informing the public about cancer treatment options contribute to this trend. As patients become more engaged in their healthcare decisions, the pd l1-inhibitors market is likely to experience increased uptake and utilization of these innovative therapies.

Emerging Biomarker Research

Emerging biomarker research is poised to transform the pd l1-inhibitors market. In Germany, the identification of specific biomarkers associated with tumor response to pd l1-inhibitors is gaining traction. This research enables the stratification of patients who are most likely to benefit from these therapies, thereby enhancing treatment outcomes. As biomarker testing becomes more prevalent, it is expected to drive the adoption of pd l1-inhibitors in clinical practice. Furthermore, the integration of biomarker research into clinical trials may lead to more personalized treatment approaches, aligning with the broader trend towards precision medicine. Consequently, the pd l1-inhibitors market stands to gain from advancements in biomarker research, which could facilitate more effective and targeted therapies.

Increasing Cancer Incidence

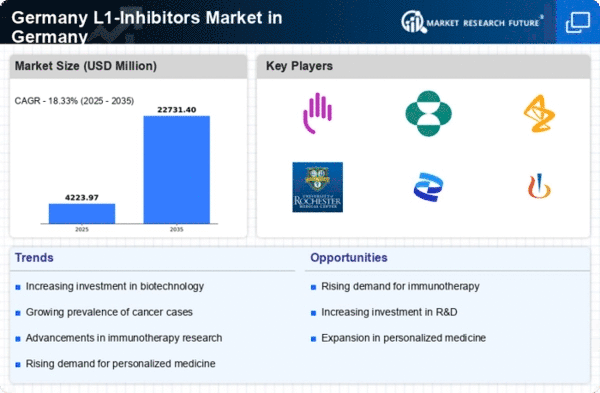

The rising incidence of cancer in Germany is a pivotal driver for the pd l1-inhibitors market. According to recent statistics, cancer cases have surged, with estimates indicating that approximately 500,000 new cases are diagnosed annually. This alarming trend necessitates the development and adoption of innovative therapies, including pd l1-inhibitors, which are designed to enhance the immune response against tumors. As healthcare providers seek effective treatment options, the demand for pd l1-inhibitors is expected to grow significantly. Furthermore, the increasing awareness among patients and healthcare professionals about the benefits of immunotherapy contributes to this market expansion. The urgency to address the cancer burden in Germany propels investments in research and development, thereby fostering a conducive environment for the pd l1-inhibitors market.

Government Funding and Support

Government funding and support play a crucial role in the development of the pd l1-inhibitors market. In Germany, public and private investments in cancer research have increased, with the government allocating substantial resources to support innovative therapies. For instance, funding initiatives aimed at enhancing research capabilities and accelerating the development of pd l1-inhibitors have been established. This financial backing not only aids in the clinical development of these therapies but also encourages collaboration between research institutions and pharmaceutical companies. As a result, the pd l1-inhibitors market is likely to benefit from enhanced research capabilities and expedited pathways to market entry, ultimately improving patient access to these vital treatments.

Advancements in Clinical Research

Ongoing advancements in clinical research are significantly influencing the pd l1-inhibitors market. Germany is home to numerous research institutions and pharmaceutical companies that are actively engaged in clinical trials aimed at evaluating the efficacy and safety of pd l1-inhibitors. Recent data suggests that over 100 clinical trials involving these inhibitors are currently underway in the country. This robust research landscape not only enhances the understanding of pd l1-inhibitors but also facilitates their integration into treatment protocols. As new findings emerge, they are likely to inform clinical practice and regulatory approvals, thereby driving market growth. The collaboration between academia and industry further strengthens the research ecosystem, ensuring that innovative therapies reach patients in a timely manner.