Rising Incidence of Cancer

The increasing incidence of cancer in Germany is a primary driver for the liquid biopsy market. With cancer cases projected to rise, the demand for non-invasive diagnostic methods is likely to grow. Liquid biopsies offer a less invasive alternative to traditional tissue biopsies, allowing for earlier detection and monitoring of cancer. According to recent statistics, cancer is expected to affect approximately 500,000 individuals annually in Germany. This alarming trend underscores the necessity for innovative diagnostic solutions, positioning the liquid biopsy market as a critical component in the healthcare landscape. As healthcare providers seek efficient and effective methods for cancer detection, the liquid biopsy market is poised for substantial growth, potentially reaching a valuation of €1 billion by 2027.

Regulatory Framework Enhancements

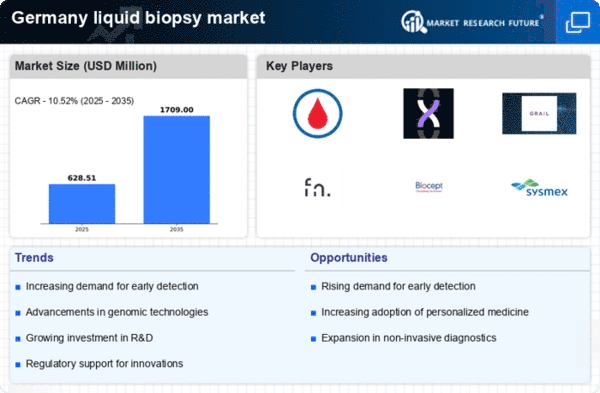

Enhancements in the regulatory framework surrounding liquid biopsies are fostering growth in the market. In Germany, regulatory bodies are increasingly recognizing the importance of liquid biopsy technologies in clinical diagnostics. Streamlined approval processes and clear guidelines for the validation of liquid biopsy tests are encouraging manufacturers to invest in this sector. As regulatory support strengthens, the liquid biopsy market is expected to expand, with new products entering the market more rapidly. This regulatory environment may lead to a projected market growth of 10% annually, as stakeholders capitalize on the opportunities presented by a more favorable regulatory landscape.

Advancements in Biomarker Discovery

The liquid biopsy market is significantly influenced by advancements in biomarker discovery. As researchers identify new biomarkers associated with various diseases, the potential applications of liquid biopsies expand. These advancements enable the development of more precise and targeted therapies, enhancing patient outcomes. In Germany, the focus on personalized medicine is driving the need for innovative diagnostic tools. The liquid biopsy market is expected to benefit from this trend, as it allows for real-time monitoring of treatment responses through the analysis of circulating tumor DNA (ctDNA) and other biomarkers. This could lead to a market growth rate of approximately 15% annually, reflecting the increasing reliance on liquid biopsies in clinical settings.

Growing Demand for Minimally Invasive Procedures

The growing demand for minimally invasive procedures is a significant driver for the liquid biopsy market. Patients and healthcare providers in Germany are increasingly favoring non-invasive diagnostic methods that reduce discomfort and recovery time. Liquid biopsies align with this trend, offering a safe and effective alternative to traditional biopsy methods. The convenience of obtaining blood samples, coupled with the ability to gather critical information about tumor dynamics, positions liquid biopsies as a preferred choice in clinical practice. This shift in patient preference is likely to propel the liquid biopsy market forward, with an anticipated growth rate of 12% annually as more healthcare facilities adopt these innovative diagnostic solutions.

Increased Investment in Research and Development

Investment in research and development (R&D) within the liquid biopsy market is a crucial driver of growth. In Germany, both public and private sectors are allocating substantial funds to advance liquid biopsy technologies. This investment is aimed at enhancing the sensitivity and specificity of liquid biopsy tests, making them more reliable for clinical use. The German government has recognized the potential of liquid biopsies in revolutionizing cancer diagnostics and is supporting initiatives to foster innovation in this field. As a result, the liquid biopsy market is likely to experience accelerated growth, with R&D expenditures projected to increase by 20% over the next five years, further solidifying its role in modern healthcare.