Increasing Aging Population

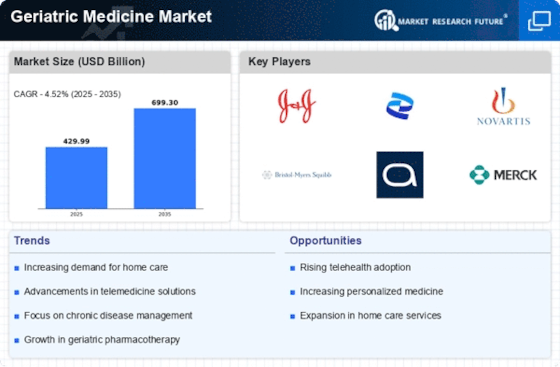

The Geriatric Medicine Market is experiencing a notable surge due to the increasing aging population. As life expectancy rises, the proportion of older adults is expanding, leading to a higher demand for specialized medical care. According to recent statistics, individuals aged 65 and older are projected to reach 1.5 billion by 2050, which indicates a significant market opportunity for geriatric services. This demographic shift necessitates tailored healthcare solutions, as older adults often face multiple chronic conditions requiring comprehensive management. Consequently, healthcare providers are adapting their services to meet the unique needs of this population, thereby driving growth in the Geriatric Medicine Market.

Advancements in Medical Technology

Technological advancements are playing a pivotal role in shaping the Geriatric Medicine Market. Innovations such as telemedicine, wearable health devices, and electronic health records are enhancing the quality of care for older adults. For instance, telehealth services have become increasingly prevalent, allowing healthcare professionals to monitor patients remotely and provide timely interventions. This shift not only improves patient outcomes but also reduces healthcare costs. Furthermore, the integration of artificial intelligence in diagnostics and treatment planning is streamlining processes, making healthcare more efficient. As these technologies continue to evolve, they are likely to further transform the Geriatric Medicine Market, offering new avenues for growth and improved patient care.

Policy Changes and Healthcare Reforms

Policy changes and healthcare reforms are significantly impacting the Geriatric Medicine Market. Governments are increasingly recognizing the need for improved healthcare services for older adults, leading to the implementation of policies that promote access to geriatric care. For example, initiatives aimed at enhancing Medicare coverage for preventive services are encouraging older adults to seek timely medical attention. Additionally, reforms that support interdisciplinary care models are fostering collaboration among healthcare providers, which is essential for delivering comprehensive care to older patients. These policy shifts are likely to create a more favorable environment for the Geriatric Medicine Market, facilitating growth and innovation in geriatric healthcare services.

Rising Prevalence of Chronic Diseases

The Geriatric Medicine Market is significantly influenced by the rising prevalence of chronic diseases among older adults. Conditions such as diabetes, heart disease, and arthritis are becoming increasingly common, necessitating specialized medical attention. Data indicates that approximately 80% of older adults have at least one chronic condition, which underscores the urgent need for effective management strategies. This trend is prompting healthcare systems to invest in geriatric care programs that focus on chronic disease management, rehabilitation, and preventive care. As a result, the Geriatric Medicine Market is likely to expand as healthcare providers seek to address the complexities associated with managing multiple chronic conditions in the aging population.

Growing Awareness of Geriatric Health Issues

There is a growing awareness of geriatric health issues, which is driving demand within the Geriatric Medicine Market. Educational campaigns and community outreach programs are informing both healthcare professionals and the public about the unique health challenges faced by older adults. This increased awareness is leading to a greater emphasis on preventive care and early intervention strategies, which are crucial for improving health outcomes in this demographic. Furthermore, as families become more involved in the care of elderly relatives, there is a heightened demand for resources and support services tailored to geriatric needs. This trend is likely to propel the Geriatric Medicine Market forward, as stakeholders seek to address the complexities of aging.