Regulatory Support and Frameworks

The establishment of supportive regulatory frameworks is playing a crucial role in the growth of the Regenerative Medicine Market. Regulatory agencies are increasingly recognizing the potential of regenerative therapies and are streamlining approval processes to facilitate their entry into the market. For example, the introduction of expedited pathways for regenerative medicine products is encouraging companies to invest in research and development. This regulatory support not only enhances the speed of bringing innovative therapies to patients but also instills confidence among investors and stakeholders. As regulatory environments continue to evolve, the Regenerative Medicine Market is likely to experience increased activity, with more products receiving approval and entering clinical practice, thereby expanding treatment options for patients.

Advancements in Stem Cell Research

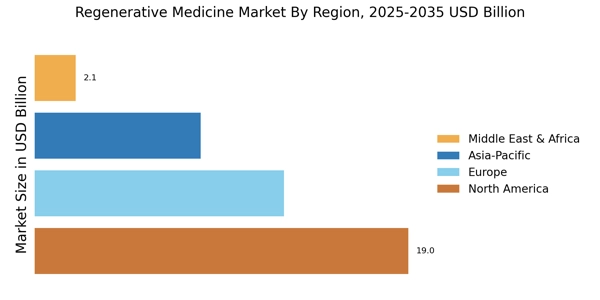

Recent advancements in stem cell research are significantly influencing the Regenerative Medicine Market. Stem cells possess the unique ability to differentiate into various cell types, making them invaluable for treating a range of conditions, including spinal cord injuries and degenerative diseases. The Regenerative Medicine Market is projected to reach USD 20 billion by 2025, reflecting the increasing recognition of stem cell applications in regenerative medicine. Furthermore, ongoing research is uncovering new methods for stem cell extraction and manipulation, enhancing their therapeutic potential. As scientific understanding deepens, the integration of stem cell therapies into clinical practice is likely to expand, driving growth in the Regenerative Medicine Market. This trend suggests a promising future for innovative treatments that leverage the capabilities of stem cells.

Rising Demand for Personalized Medicine

The shift towards personalized medicine is significantly impacting the Regenerative Medicine Market. Patients are increasingly seeking treatments tailored to their individual genetic profiles and health conditions. Regenerative medicine, with its focus on individualized therapies, aligns well with this trend. The market for personalized medicine is projected to reach USD 2 trillion by 2025, indicating a robust demand for customized treatment solutions. This growing preference for personalized approaches is driving research into gene editing, cell therapy, and other regenerative techniques that can be adapted to meet specific patient needs. As healthcare providers embrace personalized medicine, the Regenerative Medicine Market is expected to flourish, offering innovative therapies that enhance treatment efficacy and patient satisfaction.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, cardiovascular disorders, and neurodegenerative conditions is a primary driver of the Regenerative Medicine Market. As these diseases become more prevalent, the demand for innovative treatment options intensifies. Regenerative medicine offers potential solutions through cell therapy, tissue engineering, and gene therapy, which aim to restore normal function. According to recent estimates, chronic diseases account for approximately 70% of all deaths worldwide, underscoring the urgent need for effective therapies. This growing patient population is likely to propel investments in regenerative medicine, as healthcare providers seek to improve patient outcomes and reduce long-term healthcare costs. Consequently, the Regenerative Medicine Market is expected to experience substantial growth as stakeholders respond to this pressing healthcare challenge.

Growing Investment in Regenerative Medicine

Investment in the Regenerative Medicine Market is witnessing a notable surge, driven by both public and private sectors. Venture capital funding for regenerative medicine startups has increased significantly, with investments reaching over USD 5 billion in recent years. This influx of capital is facilitating research and development efforts, enabling the rapid advancement of novel therapies. Additionally, government initiatives aimed at promoting regenerative medicine research are further bolstering this trend. For instance, various countries are establishing funding programs and grants to support innovative projects in this field. As financial backing continues to grow, the Regenerative Medicine Market is poised for accelerated innovation and commercialization of groundbreaking therapies, ultimately benefiting patients and healthcare systems alike.