GCC Property Insurance Market

GCC Property Insurance Market Size, Share and Research Report By Insurance Type (Homeowners Insurance, Renters Insurance, Condo Insurance, Flood Insurance, Earthquake Insurance), By Coverage Type (Actual Cash Value, Replacement Cost, Extended Replacement Cost, Guaranteed Replacement Cost), By End Use (Residential, Commercial, Industrial) and By Distribution Channel (Direct Sales, Brokerage, Online Platforms, Banks)- Industry Forecast Till 2035

GCC Property Insurance Market Overview

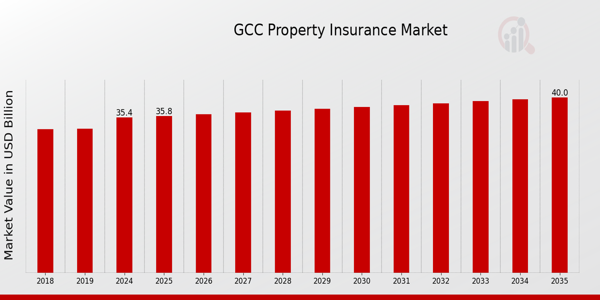

As per MRFR analysis, the GCC Property Insurance Market Size was estimated at 34.28 (USD Billion) in 2023.The GCC Property Insurance Market is expected to grow from 35.4(USD Billion) in 2024 to 40 (USD Billion) by 2035. The GCC Property Insurance Market CAGR (growth rate) is expected to be around 1.117% during the forecast period (2025 - 2035).

Key GCC Property Insurance Market Trends Highlighted

The GCC Property Insurance Market is currently experiencing several notable trends driven by the region's economic growth and development initiatives. Increased urbanization in major cities across the Gulf Cooperation Council (GCC) countries is leading to a surge in real estate projects, requiring robust property insurance solutions. The government's focus on infrastructure projects, including housing developments and commercial properties, supports the growing demand for property insurance coverage.

Furthermore, the influence of regulatory changes aimed at enhancing consumer protection is leading insurers to develop more competitive and comprehensive policy offerings.As technology use grows in the GCC, new opportunities are opening up in fields like digital insurance solutions. Insurers are starting to use digital platforms to interact with customers and process claims, which makes things run more smoothly and improves customer service. Also, more people are realizing how important it is to assess and manage risk when investing in property.

This has led to the growth of specialty insurance products that are made for specific industries, such as tourism and hospitality, which are very important to the GCC economy. In the property sector, there has been a shift toward more environmentally friendly practices, and insurers are actively promoting green building insurance policies.

This shift aligns with the GCC’s commitment to sustainability, particularly in countries like Saudi Arabia and the UAE, where initiatives to create eco-friendly urban environments are gaining momentum. There is also an emphasis on integrating smart technology into properties, leading to potential demand for specialized coverage that takes into account the risks associated with smart buildings. Overall, the GCC Property Insurance Market is evolving to meet the changing needs of its stakeholders, driven by both economic and environmental considerations.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

GCC Property Insurance Market Drivers

Increasing Urbanization and Infrastructure Development

The Gulf Cooperation Council (GCC) countries are experiencing rapid urbanization and significant infrastructure development, which is a key driver for the GCC Property Insurance Market. A report from the Gulf Research Center outlines that the GCC region is expected to invest approximately USD 1.3 trillion in infrastructure projects over the next decade, focusing on enhancing urban landscapes and transport networks.

Such developments lead to higher property values, necessitating increased property insurance coverage.Moreover, organizations like the Qatar National Vision 2030 and the Saudi Vision 2030 initiative emphasize investments in urban growth and infrastructure, further fueling demand for property insurance. This upward trend ensures that property insurance becomes a crucial element in safeguarding these valuable assets against potential risks, ultimately bolstering the market growth.

Growing Awareness of Natural Disasters

The GCC region is increasingly facing the impact of natural disasters such as floods and sandstorms, leading to a heightened awareness of the importance of property insurance. The World Bank estimates that the Middle East and North Africa (MENA) region is projected to see an average of 20% increase in frequency and severity of extreme weather-related events over the next decade.

This creates a pressing need for robust property insurance solutions.Governments in the region, such as the UAE's National Emergency Crisis and Disasters Management Authority, have begun to implement policies aimed at disaster preparedness, working closely with insurance companies to educate property owners on the necessity of maintaining comprehensive property insurance to mitigate potential losses from such events.

Technological Advancements in Insurance Services

Technological innovations, including the use of artificial intelligence and data analytics, are reshaping the GCC Property Insurance Market by enhancing the efficiency of operations and customer service. The Dubai Financial Services Authority has initiated programs to encourage fintech innovations in the insurance sector, which allows companies to personalize offerings and streamline claims processes.

According to a report by the International Association of Insurance Supervisors, insurers who adopt technology can reduce operational costs by up to 30%.These advancements improve customer experience, attracting a broader audience to property insurance solutions in the GCC, thereby encouraging market expansion.

Regulatory Mandates for Property Insurance

The GCC governments are increasingly implementing regulatory frameworks that mandate property insurance as part of their efforts to protect citizens and ensure financial stability. For instance, in the UAE, local authorities have issued regulations that require property owners to obtain insurance coverage to safeguard against liability and property damage in real estate developments.

Similar moves are being observed in Saudi Arabia, where the Council of Cooperative Health Insurance has been instrumental in regulating various insurance products, leading to an uptick in property insurance policies.This focus on regulation underscores the growing recognition of property insurance as a critical component of risk management, contributing to the overall growth of the GCC Property Insurance Market.

GCC Property Insurance Market Segment Insights

Property Insurance Market Insurance Type Insights

The GCC Property Insurance Market, primarily segmented by Insurance Type showcases a diverse range of coverage options that cater to various property ownership scenarios and risks. Homeowners Insurance plays a vital role as it protects individuals against damage to their homes, covering not only physical damage but also liability for accidents that may occur on their premises. This segment is significant given the ongoing urbanization and real estate development in the GCC region, where property values have escalated considerably. Renters Insurance has also gained traction as more residents opt for rental properties, especially in urban areas where housing availability is limited. This type of insurance typically covers personal belongings within rented accommodations and provides liability coverage, reflecting the changing demographic and lifestyle trends within the cities of the GCC.

Condo Insurance, similarly, addresses the unique needs of condominium owners, covering interior damages and providing protection that is often not included in the association's master policy. This segment is particularly noteworthy as the popularity of condominiums continues to rise amidst high-density living scenarios in many GCC countries. Flood Insurance is critical within this market, especially considering the region's geographical susceptibility to sudden and severe weather changes.

With the increasing impact of climate change, the demand for flood protection has become paramount for property owners, driving this aspect of the insurance segment. Earthquake Insurance serves as an essential coverage option as well, particularly in areas prone to seismic activity. The importance of such coverage cannot be overstated when assessing the risk and financial repercussions associated with natural disasters.In summary, the segmented GCC Property Insurance Market under the Insurance Type umbrella highlights significant coverage options for homeowners, renters, condo owners, and those at risk of natural disasters.

This diversity not only provides tailored options to meet specific needs but also underlines the overall growth potential in the GCC, driven by a burgeoning real estate market and emerging demographic trends. The unique challenges faced by this region offer opportunities for innovation and enhancement in property insurance solutions, fostering a robust market environment. Thus, understanding these segments is crucial for stakeholders aiming to navigate the complexities of the GCC property insurance landscape.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Property Insurance Market Coverage Type Insights

The Coverage Type segment of the GCC Property Insurance Market plays a vital role in the overall landscape of the industry, providing diverse insurance solutions to meet varying customer needs. Actual Cash Value offers a foundational protection model, reflecting the depreciation of insured items, thus appealing to cost-conscious consumers. Meanwhile, Replacement Cost coverage is increasingly favored for its ability to reimburse policyholders for the full cost of replacing damaged or lost property without depreciation adjustments, which is particularly relevant given the rising value of assets in the GCC region.

Extended Replacement Cost provides an additional layer of security by covering costs that exceed typical replacement amounts, addressing the growing concern over inflated construction and repair expenses in a rapidly developing market. Lastly, Guaranteed Replacement Cost appeals to those seeking comprehensive peace of mind, ensuring that a policyholder can replace their property regardless of the fluctuating market conditions. These various types of coverage reflect the preferences and financial considerations of consumers in the GCC, driven by rapid urbanization, population growth, and evolving housing developments, thus shaping the overall GCC Property Insurance Market's segmentation and reinforcing its significance in the regional economy.

Property Insurance Market End Use Insights

The GCC Property Insurance Market exhibits a diversified structure with notable emphasis on End Use segments, particularly Residential, Commercial, and Industrial properties. The Residential segment plays a crucial role, with a growing trend of urbanization and an increasing number of expatriates in the GCC countries, leading to higher demand for home insurance.

Concurrently, the Commercial segment reflects significant growth due to the expansion of businesses and investment in real estate development across the region. This segment is essential as it includes coverage for offices, retail spaces, and warehouses, providing protection against various risks that businesses face. The Industrial segment, while smaller, is gaining importance due to the rise in manufacturing and infrastructure projects, particularly driven by government initiatives focusing on economic diversification and sustainability.

These segments are important as they collectively contribute to the overall stability and growth of the GCC Property Insurance Market, responding to a dynamic economic landscape. Additionally, challenges such as increasing natural disasters and regulatory changes play a significant role in shaping the strategies adopted within these End Use segments. As the GCC nations prioritize economic resilience, these segments present ample opportunities for insurers to innovate and tailor their offerings to meet the evolving needs of various property owners. The GCC Property Insurance Market data reflects the variations in demand across these segments, highlighting the importance of localized solutions to address specific risks and requirements.

Property Insurance Market Distribution Channel Insights

The Distribution Channel segment of the GCC Property Insurance Market plays a crucial role in ensuring the accessibility of insurance products to consumers across the region. Direct Sales are increasingly gaining traction as they allow insurance companies to establish direct relationships with customers, facilitating personalized services and tailored insurance solutions.

Brokerage services continue to thrive, benefiting from their in-depth market knowledge and ability to navigate complex insurance needs, making them preferred choices for consumers seeking expert advice.Online Platforms have revolutionized the way insurance products are sold, providing convenience and efficiency to tech-savvy customers who appreciate the ability to compare policies easily and make informed decisions. Banks also serve as significant distribution channels, leveraging their established customer bases to offer integrated financial solutions, enhancing customer experience.

The diverse distribution channels are essential for accommodating various consumer preferences and behaviors in the GCC region, while also contributing to the overall growth of the GCC Property Insurance Market by increasing reach and facilitating improved market penetration.This multi-faceted approach to distribution allows insurers to address unique regional needs and capitalizes on the growing demand for property insurance amid rising urbanization and economic development in the GCC.

GCC Property Insurance Market Key Players and Competitive Insights

The GCC Property Insurance Market is characterized by a dynamic landscape where various players compete to capture market share through innovative solutions and customer-oriented services. This market has seen significant growth due to rising property investments in the Gulf Cooperation Council region, driven by ongoing urbanization and economic diversification efforts. Companies are focusing on providing comprehensive insurance packages to meet the diverse needs of property owners and tenants, as well as enhancing customer engagement through technology and digital platforms. In this competitive arena, firms strive to differentiate themselves by offering tailored solutions, improving claim processing times, and enhancing customer service experiences.

Regulatory frameworks specific to each GCC country also influence market strategies as companies navigate compliance requirements while aiming to balance risk and profitability.Takaful Emarat Insurance has established itself as a notable player in the GCC Property Insurance Market by adopting a customer-centric approach that emphasizes collaboration and inclusivity. The company focuses on providing Sharia-compliant insurance solutions, which resonate well in the region’s predominantly Islamic market. One of its key strengths lies in its diverse property insurance offerings that cater to both residential and commercial clients, positioning it effectively within the local market. The company leverages advanced technology to enhance its service delivery, allowing for quick and efficient policy management and claims processing.

Takaful Emarat Insurance also emphasizes strong relationships with its distribution partners, which significantly enhances its market presence and accessibility to clients across the GCC region.Oman United Insurance Company is another significant entity in the GCC Property Insurance Market that has built a solid reputation for reliability and customer service. The company offers a wide range of property insurance products, including coverage for residential, commercial, and industrial properties, thus catering to various segments within the market. Its strengths include a strong underwriting process and a commitment to meeting the specific insurance needs of individuals and businesses in the GCC region.

The company has a robust market presence bolstered by strategic partnerships and alliances that enhance its operational capabilities. In recent years, Oman United Insurance Company has also engaged in mergers and acquisitions to expand its portfolio and enhance its competitive edge, enabling it to better serve its clients with comprehensive insurance solutions. This strategic growth has reinforced its position within the market while ensuring adherence to the ever-evolving regulatory landscape in the GCC.

Key Companies in the GCC Property Insurance Market Include:

- Takaful Emarat Insurance

- Oman United Insurance Company

- AXA Gulf

- Abu Dhabi National Insurance Company

- Dubai Investments Insurance Company

- National General Insurance Company

- Arabian Shield Cooperative Insurance Company

- Mutual Insurance Company of Abu Dhabi

- Al Ain Ahlia Insurance Company

- Raha Insurance Company

- Gulf Insurance Group

- Emirates Insurance Company

- Qatar Insurance Company

GCC Property Insurance Market Developments

The GCC Property Insurance Market has seen significant developments recently. Takaful Emarat Insurance has been expanding its digital offerings to enhance customer engagement and streamline policy management. Oman United Insurance Company announced improved profitability due to an increase in premium collections and cost containment strategies. AXA Gulf has been focusing on sustainability initiatives, reflecting the growing trend towards environmentally responsible insurance solutions in the region.

In October 2023, Abu Dhabi National Insurance Company completed the acquisition of a minor stake in Dubai Investments Insurance Company, aiming to diversify and strengthen its market presence. Additionally, National General Insurance Company launched a new coverage plan targeting the commercial real estate sector, responding to rising demand. Arabian Shield Cooperative Insurance Company has reported a substantial increase in its market share, fueled by innovative products catering to small and medium-sized enterprises.

The overall growth in the market valuation of companies is reflective of increasing awareness and demand for property insurance among consumers and businesses in the GCC. Furthermore, historical trends indicate that the market has experienced steady growth over the past few years, attributed to regulatory support and economic diversification efforts across the region.

GCC Property Insurance Market Segmentation Insights

Property Insurance Market Insurance Type Outlook

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Flood Insurance

- Earthquake Insurance

Property Insurance Market Coverage Type Outlook

- Actual Cash Value

- Replacement Cost

- Extended Replacement Cost

- Guaranteed Replacement Cost

Property Insurance Market End Use Outlook

- Residential

- Commercial

- Industrial

Property Insurance Market Distribution Channel Outlook

- Direct Sales

- Brokerage

- Online Platforms

- Banks

FAQs

What is the expected market size of the GCC Property Insurance Market in 2024?

The GCC Property Insurance Market is expected to be valued at 35.4 USD Billion in 2024.

What market value is projected for the GCC Property Insurance Market by 2035?

The market is projected to reach a value of 40.0 USD Billion by 2035.

What is the expected CAGR for the GCC Property Insurance Market between 2025 and 2035?

The expected CAGR for the GCC Property Insurance Market from 2025 to 2035 is 1.117%.

Which insurance type has the largest market value in 2024 within the GCC Property Insurance Market?

Homeowners Insurance has the largest market value at 15.0 USD Billion in 2024.

What is the projected market size for Renters Insurance in 2035?

Renters Insurance is projected to reach a market size of 8.5 USD Billion by 2035.

Who are some key players in the GCC Property Insurance Market?

Key players include Takaful Emarat Insurance, AXA Gulf, and Qatar Insurance Company among others.

What are the projected values for Flood Insurance in 2024 and 2035?

Flood Insurance is valued at 3.0 USD Billion in 2024 and is expected to reach 3.5 USD Billion by 2035.

What is the market value for Earthquake Insurance in 2024?

Earthquake Insurance is valued at 4.4 USD Billion in 2024.

How much is the Condo Insurance market expected to grow by 2035?

Condo Insurance is expected to grow from 5.0 USD Billion in 2024 to 5.5 USD Billion by 2035.

What are the primary growth drivers impacting the GCC Property Insurance Market?

Key growth drivers include increasing urbanization and rising property investments in the region.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”