Rising Demand for Energy Efficiency

The Commercial Refrigeration Equipment Industry is witnessing a pronounced shift towards energy-efficient solutions. As businesses increasingly prioritize sustainability, the demand for refrigeration systems that minimize energy consumption is escalating. For instance, energy-efficient models can reduce operational costs significantly, appealing to both large retailers and small businesses. This trend is underscored by the projected market value of 39.5 USD Billion in 2024, reflecting a growing inclination towards eco-friendly technologies. Furthermore, regulatory frameworks worldwide are tightening, compelling manufacturers to innovate and comply with energy standards, thereby driving the market's growth.

Expansion of the Food and Beverage Sector

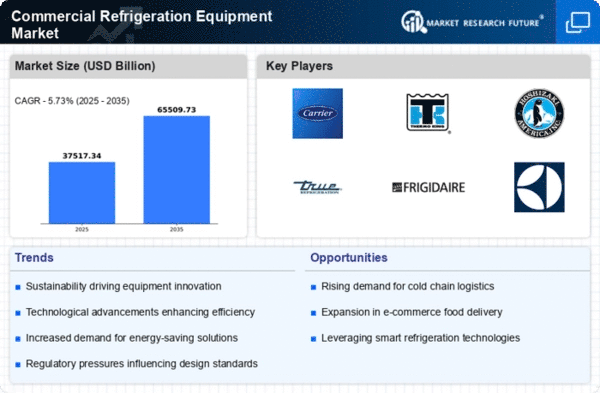

The Commercial Refrigeration Equipment Industry is closely tied to the expansion of the food and beverage sector. As consumer preferences evolve towards fresh and frozen products, the need for advanced refrigeration solutions intensifies. The market is projected to reach 55 USD Billion by 2035, indicating robust growth driven by increased food service establishments and retail outlets. This expansion necessitates the adoption of sophisticated refrigeration systems that ensure product quality and safety. Additionally, the rise of online food delivery services further amplifies the demand for reliable refrigeration, as businesses seek to maintain optimal storage conditions during transit.

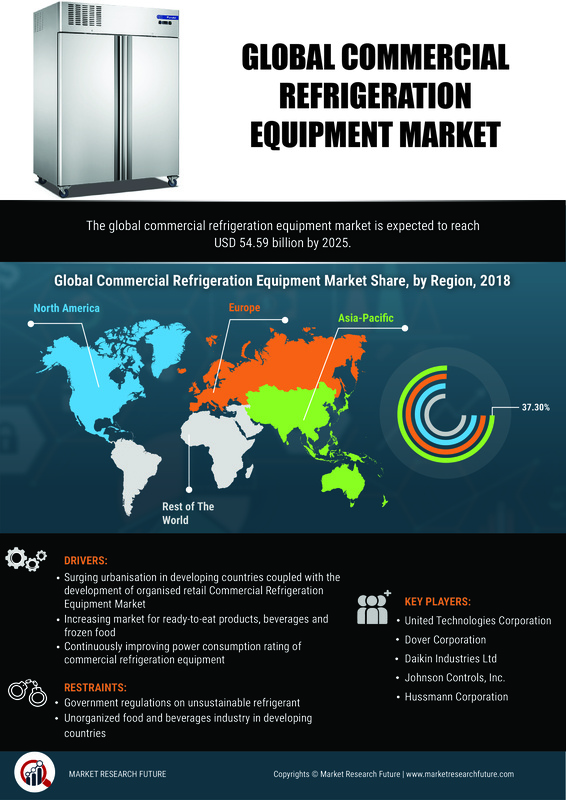

Increasing Urbanization and Retail Growth

Urbanization is a key driver of the Commercial Refrigeration Equipment Industry. As urban populations expand, the demand for retail spaces and food service establishments rises. This trend necessitates the installation of efficient refrigeration systems to cater to the growing consumer base. The projected CAGR of 3.05% from 2025 to 2035 indicates a steady growth trajectory, fueled by the proliferation of supermarkets, convenience stores, and restaurants in urban areas. Retailers are increasingly investing in modern refrigeration solutions to enhance customer experience and ensure product availability, thereby propelling market growth.

Technological Advancements in Refrigeration

Technological advancements are significantly influencing the Commercial Refrigeration Equipment Market. Innovations such as smart refrigeration systems, IoT integration, and advanced monitoring technologies are enhancing operational efficiency and reliability. These advancements enable businesses to optimize energy use and reduce waste, aligning with sustainability goals. The introduction of smart sensors and automated controls allows for real-time monitoring of temperature and humidity, ensuring product integrity. As the market evolves, these technologies are likely to become standard, driving further investment and growth within the industry.

Regulatory Compliance and Food Safety Standards

Regulatory compliance is a critical factor influencing the Commercial Refrigeration Equipment Market. Governments worldwide are implementing stringent food safety standards that require businesses to maintain specific temperature controls for perishable goods. This regulatory landscape compels companies to invest in advanced refrigeration technologies that meet compliance requirements. As a result, manufacturers are innovating to develop systems that not only comply with regulations but also enhance operational efficiency. The emphasis on food safety is likely to drive demand for reliable refrigeration solutions, contributing to the overall market growth.

Leave a Comment