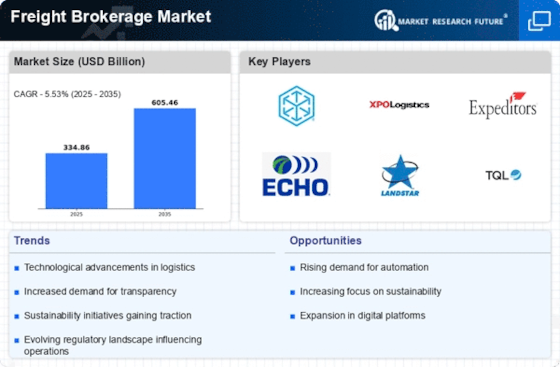

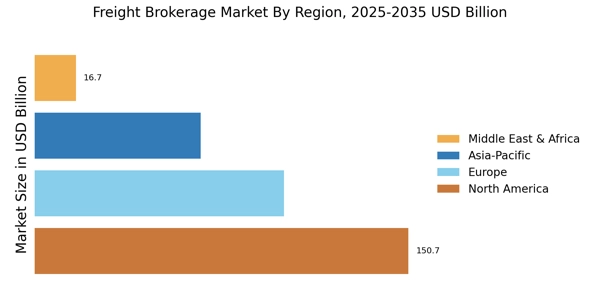

North America : Logistics Powerhouse

According to the Freight Brokerage Market Analysis, North America remains the largest market, driven by advanced logistics infrastructure and e-commerce growth for approximately 45% of the global market share. Key growth drivers of US freight brokerage market include the rise in e-commerce, increased demand for efficient supply chain solutions, and regulatory support for transportation infrastructure. The U.S. government has been investing in logistics and transportation, enhancing the overall US freight brokerage market environment. According to recent reports, the US freight brokerage market size accounts for nearly 40–45% of the North American market, driven by e-commerce and industrial growth.

The competitive landscape of US freight brokerage market size is led by major players such as C.H. Robinson, XPO Logistics, and Expeditors International. The U.S. is the primary freight brokerage market followed by Canada, which holds around 10% of the market share. The presence of established companies and a robust logistics network further solidify North America's position in the freight brokerage sector. Recent expansions and partnerships among major logistics providers are expected to positively impact the US Freight Brokerage Market Size over the next decade. The US Freight Brokerage Market Size is estimated to account for a major share of the North American market, driven by industrial growth, e-commerce expansion, and advanced transportation infrastructure. Sustainability initiatives in the US are expected to influence the US Freight Brokerage Market Size, with greener transportation options gaining traction.

Europe : Emerging Freight Hub

Europe is witnessing significant growth in the freight brokerage market size, driven by increasing cross-border trade and regulatory initiatives aimed at enhancing logistics efficiency. The region holds approximately 30% of the global freight brokerage market share, with Germany and the UK being the largest contributors, accounting for nearly 15% and 10% respectively. Regulatory frameworks like the EU's Mobility Package are catalyzing freight brokerage market size expansion.

Leading countries in this sector include Germany, the UK, and France, with a competitive landscape featuring key players such as DB Schenker and Kuehne + Nagel. The presence of advanced logistics infrastructure and a focus on sustainability are shaping the market dynamics, making Europe a vital player in the global freight brokerage landscape.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a significant player in the freight brokerage market size, driven by rapid industrialization and urbanization. The region holds about 20% of the global market share, with China and India leading the charge, contributing approximately 12% and 5% respectively. The demand for logistics services is further fueled by the growth of e-commerce and government initiatives to improve transportation infrastructure.

Countries like China, Japan, and India are at the forefront, with a competitive landscape featuring local and international players. The presence of companies such as Sinotrans and YTO Express highlights the region's dynamic freight brokerage market size. As the logistics sector evolves, Asia-Pacific is poised for substantial growth in freight brokerage services.

Middle East and Africa : Emerging Logistics Frontier

The Middle East and Africa region is gradually developing its freight brokerage market size, currently holding about 5% of the global freight brokerage market size share. Key growth drivers include increasing trade activities, investments in logistics infrastructure, and a growing focus on supply chain optimization. Countries like the UAE and South Africa are leading the market, with the UAE accounting for approximately 3% of the share.

The competitive landscape is characterized by a mix of local and international players, with companies like Aramex and DSV making significant inroads. The region's strategic location as a trade hub between continents further enhances its potential in the freight brokerage market analysis, making it an area of interest for future investments.