Rising Incidence of Cancer

The increasing prevalence of cancer in the GCC region is a primary driver for the liquid biopsy market. According to recent statistics, cancer cases in the GCC have surged, with estimates suggesting a rise of over 20% in the last decade. This alarming trend necessitates innovative diagnostic solutions, such as liquid biopsies, which offer non-invasive testing options. Liquid biopsies enable early detection and monitoring of cancer, which is crucial for improving patient outcomes. As healthcare providers and patients seek more effective diagnostic tools, the liquid biopsy market is poised for substantial growth. The demand for these advanced diagnostic methods is likely to continue rising, driven by the urgent need for timely and accurate cancer detection in the region.

Increasing Healthcare Expenditure

The rising healthcare expenditure in the GCC countries is a significant factor propelling the liquid biopsy market. Governments in the region are investing heavily in healthcare infrastructure and advanced medical technologies. For instance, healthcare spending in the GCC is projected to reach $100 billion by 2025, reflecting a commitment to improving healthcare services. This financial support facilitates the adoption of innovative diagnostic solutions, including liquid biopsies, which are becoming integral to cancer management. As healthcare budgets expand, the liquid biopsy market is likely to benefit from increased funding for research and development, leading to enhanced product offerings and wider accessibility for patients.

Growing Awareness of Early Detection

There is a notable increase in awareness regarding the importance of early cancer detection among the population in the GCC. Public health campaigns and educational initiatives are emphasizing the benefits of early diagnosis, which is crucial for effective treatment. This heightened awareness is driving demand for non-invasive diagnostic methods, such as liquid biopsies, which can detect cancer at earlier stages. The liquid biopsy market is likely to see a surge in adoption as patients and healthcare providers recognize the advantages of these tests. As awareness continues to grow, the market is expected to expand, providing more opportunities for innovation and development in liquid biopsy technologies.

Advancements in Diagnostic Technologies

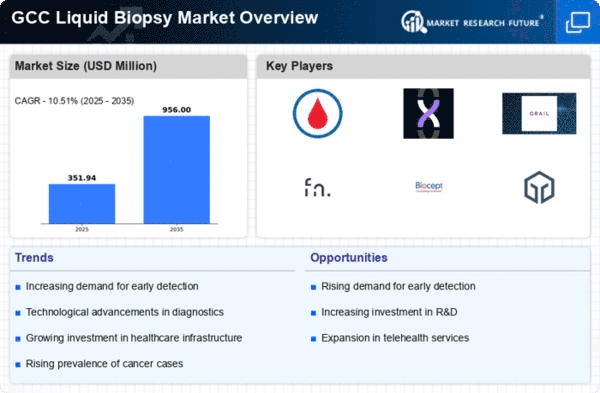

Technological innovations in diagnostic methods are significantly influencing the liquid biopsy market. The development of next-generation sequencing (NGS) and advanced bioinformatics tools has enhanced the sensitivity and specificity of liquid biopsies. These advancements allow for the detection of minimal residual disease and genetic mutations with greater accuracy. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by these technological improvements. As healthcare systems in the GCC increasingly adopt these cutting-edge technologies, the liquid biopsy market is expected to expand, providing healthcare professionals with more reliable tools for cancer diagnosis and treatment monitoring.

Regulatory Support for Innovative Diagnostics

Regulatory bodies in the GCC are increasingly supporting the development and approval of innovative diagnostic solutions, including liquid biopsies. Streamlined regulatory processes and favorable policies are encouraging companies to invest in research and development of these advanced technologies. This supportive environment is crucial for the liquid biopsy market, as it facilitates quicker access to the market for new products. As regulatory frameworks evolve to accommodate innovative diagnostics, the liquid biopsy market is likely to experience accelerated growth. The collaboration between regulatory agencies and industry stakeholders may lead to enhanced product offerings and improved patient access to cutting-edge diagnostic tools.