Increased Focus on Cybersecurity

As the enterprise quantum-computing market evolves, there is a growing emphasis on cybersecurity measures to protect sensitive data. Quantum computing has the potential to revolutionize encryption methods, making traditional security protocols obsolete. In the GCC, organizations are increasingly aware of the risks associated with cyber threats and are investing in quantum-safe encryption technologies. This shift is expected to drive demand for quantum computing solutions that can enhance data security. Reports suggest that the cybersecurity market in the region is projected to grow by over 20% annually, with quantum technologies playing a crucial role in this transformation. Consequently, the intersection of cybersecurity and quantum computing is likely to be a significant driver for the enterprise quantum-computing market.

Government Initiatives and Funding

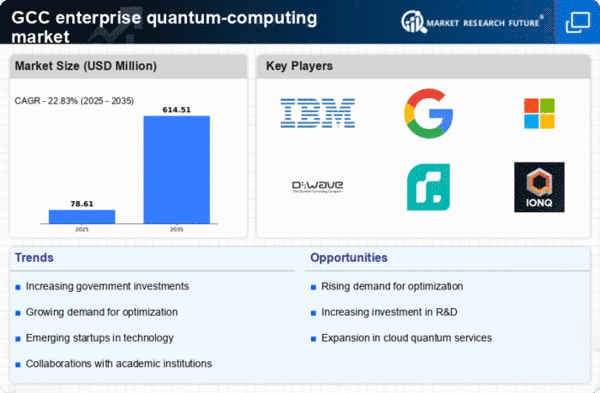

Government initiatives in the GCC are playing a pivotal role in the growth of the enterprise quantum-computing market. Various national strategies are being implemented to promote technological advancements and innovation. For instance, countries like the UAE and Saudi Arabia have launched funding programs aimed at supporting research and development in quantum technologies. These initiatives not only provide financial backing but also foster collaboration between public and private sectors. The allocation of substantial budgets, estimated to reach millions of $ in the coming years, indicates a strong commitment to establishing a robust quantum computing ecosystem. Such government support is likely to enhance the capabilities and competitiveness of the enterprise quantum-computing market.

Emerging Startups and Innovation Hubs

The enterprise quantum-computing market is witnessing the emergence of startups and innovation hubs within the GCC. These entities are driving technological advancements and fostering a culture of innovation. Startups focused on quantum algorithms, hardware development, and software solutions are increasingly attracting venture capital and government support. The establishment of innovation hubs is facilitating collaboration among researchers, entrepreneurs, and industry stakeholders, creating an ecosystem conducive to growth. As these startups develop novel applications and solutions, they are likely to contribute significantly to the enterprise quantum-computing market. The influx of fresh ideas and approaches may accelerate the adoption of quantum technologies across various sectors, further enhancing the market landscape.

Talent Development and Education Programs

The enterprise quantum-computing market is also being influenced by the development of talent and education programs in the GCC. As the demand for skilled professionals in quantum computing rises, educational institutions are beginning to offer specialized courses and training programs. Collaborations between universities and industry leaders are fostering a new generation of experts equipped with the necessary skills to advance quantum technologies. This focus on education is crucial, as it ensures a steady pipeline of talent that can support the growth of the enterprise quantum-computing market. Furthermore, initiatives aimed at raising awareness about quantum computing among students and professionals are likely to enhance interest and investment in this field.

Rising Demand for Advanced Computing Solutions

The enterprise quantum-computing market is experiencing a surge in demand for advanced computing solutions across various sectors in the GCC. Industries such as finance, healthcare, and logistics are increasingly seeking quantum computing capabilities to solve complex problems that traditional computing cannot efficiently address. This demand is driven by the need for faster data processing and enhanced analytical capabilities. According to recent estimates, the market for quantum computing in the GCC is projected to grow at a CAGR of approximately 25% over the next five years. As organizations recognize the potential of quantum technologies to optimize operations and drive innovation, investments in this sector are likely to increase significantly, further propelling the enterprise quantum-computing market forward.