Collaboration Across Industries

The enterprise quantum-computing market is witnessing a trend of collaboration across various industries, which is essential for driving innovation and practical applications of quantum technologies. Partnerships between technology firms, research institutions, and industry leaders are becoming more common, facilitating knowledge exchange and resource sharing. These collaborations enable the development of tailored quantum solutions that address specific industry challenges, such as optimization in supply chains or drug discovery in pharmaceuticals. As these partnerships grow, they are likely to accelerate the pace of quantum technology adoption in the UK, fostering a more integrated ecosystem that supports the enterprise quantum-computing market's expansion.

Government Initiatives and Funding

The enterprise quantum-computing market is significantly influenced by government initiatives aimed at fostering innovation and technological advancement. The UK government has allocated substantial funding to support quantum research and development, with investments exceeding £1 billion in recent years. These initiatives are designed to position the UK as a leader in quantum technology, encouraging collaboration between public and private sectors. Such funding not only aids in the development of quantum infrastructure but also stimulates the growth of startups and research institutions focused on quantum computing. As a result, the enterprise quantum-computing market is likely to benefit from enhanced resources and talent, driving further advancements and applications in various industries.

Increased Focus on Data Security and Privacy

In the enterprise quantum-computing market, there is a growing emphasis on data security and privacy, particularly as organizations face escalating cyber threats. Quantum computing offers the potential to develop advanced encryption methods that could significantly enhance data protection. As businesses in the UK become more aware of the vulnerabilities associated with traditional encryption techniques, the demand for quantum-safe solutions is likely to rise. This shift is expected to drive investments in quantum security technologies, with projections indicating that the market for quantum encryption could reach £500 million by 2027. Consequently, the enterprise quantum-computing market is poised to play a crucial role in addressing the pressing need for robust security measures in an increasingly digital landscape.

Talent Development and Education Initiatives

The enterprise quantum-computing market is heavily reliant on a skilled workforce capable of navigating the complexities of quantum technologies. In response to this need, educational institutions in the UK are increasingly offering specialized programs and courses focused on quantum computing. These initiatives aim to equip students and professionals with the necessary skills to thrive in this emerging field. Furthermore, industry players are collaborating with universities to create training programs that bridge the skills gap. As a result, the availability of qualified talent is expected to improve, which could enhance innovation and drive growth within the enterprise quantum-computing market, ultimately contributing to its long-term sustainability.

Rising Demand for Advanced Computing Solutions

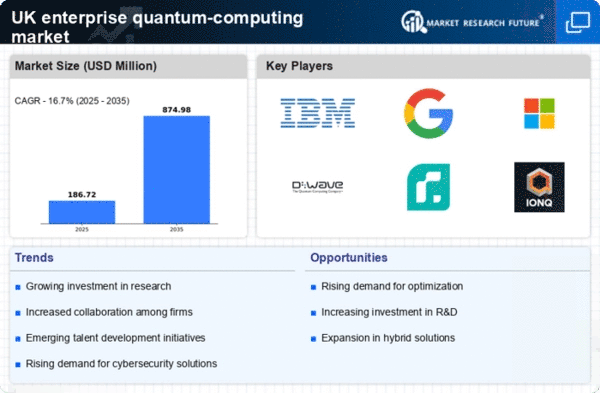

The enterprise quantum-computing market is experiencing a notable surge in demand for advanced computing solutions across various sectors in the UK. Industries such as finance, pharmaceuticals, and logistics are increasingly seeking quantum computing capabilities to solve complex problems that traditional computing cannot efficiently address. This demand is driven by the need for faster data processing and enhanced analytical capabilities. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years, indicating a robust interest in quantum technologies. As enterprises recognize the potential of quantum computing to revolutionize their operations, investments in this market are likely to escalate, further propelling its growth and adoption in the UK.