Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the enterprise quantum-computing market in France. The French government, alongside private sector players, is allocating substantial funds to foster innovation in quantum technologies. In 2025, R&D spending in this sector is anticipated to reach €1 billion, reflecting a commitment to establishing France as a leader in quantum computing. This influx of capital is likely to accelerate advancements in quantum algorithms, hardware, and software, ultimately enhancing the capabilities of the enterprise quantum-computing market. As a result, organizations are expected to leverage these innovations to gain competitive advantages in their respective fields.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are emerging as a vital driver for the enterprise quantum-computing market in France. Companies are increasingly recognizing the importance of pooling resources and expertise to tackle the complexities associated with quantum technology. Collaborations between academic institutions, research organizations, and private enterprises are fostering an environment conducive to innovation. In 2025, it is estimated that over 40% of enterprises in the quantum sector will engage in collaborative projects, enhancing knowledge sharing and accelerating the development of practical applications. This collaborative approach is likely to strengthen the enterprise quantum-computing market by creating a robust ecosystem that supports growth and innovation.

Rising Demand for Advanced Computing Solutions

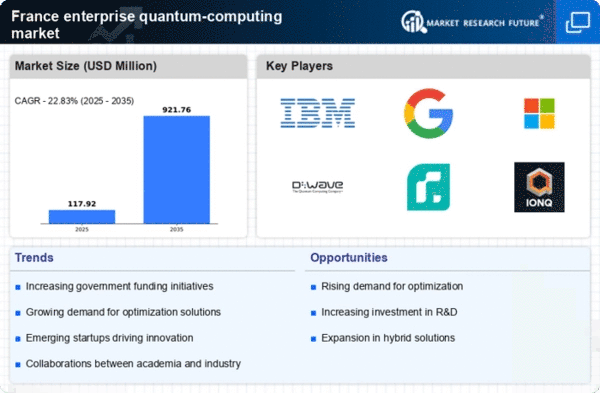

The enterprise quantum-computing market in France is experiencing a notable surge in demand for advanced computing solutions. Industries such as finance, pharmaceuticals, and logistics are increasingly seeking quantum computing capabilities to solve complex problems that classical computers struggle with. This demand is driven by the need for faster data processing and enhanced optimization techniques. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. As organizations recognize the potential of quantum computing to revolutionize their operations, investments in this technology are expected to escalate, thereby propelling the enterprise quantum-computing market forward.

Growing Awareness of Quantum Computing Benefits

Growing awareness of the benefits of quantum computing is significantly influencing the enterprise quantum-computing market in France. As businesses become more informed about the potential applications of quantum technology, they are increasingly inclined to explore its capabilities. This awareness is driven by educational initiatives, industry conferences, and publications that highlight successful case studies. By 2025, it is projected that 60% of enterprises will have a basic understanding of quantum computing and its applications. This heightened awareness is likely to lead to increased investments in quantum solutions, thereby propelling the enterprise quantum-computing market forward as organizations seek to harness its transformative potential.

Regulatory Framework and Standardization Efforts

The establishment of a regulatory framework and standardization efforts is becoming a crucial driver for the enterprise quantum-computing market in France. As the technology matures, there is a growing need for clear guidelines and standards to ensure interoperability and security. The French government is actively working on policies that promote responsible development and deployment of quantum technologies. By 2025, it is anticipated that a comprehensive regulatory framework will be in place, addressing key issues such as data privacy and ethical considerations. This regulatory clarity is likely to instill confidence among enterprises, encouraging them to invest in quantum computing solutions and thereby stimulating growth in the enterprise quantum-computing market.