Rising Cybersecurity Threats

The GCC cloud native application protection platform market is responding to an alarming increase in cybersecurity threats. Recent reports indicate that cyberattacks in the region have surged, with organizations facing sophisticated threats targeting their cloud environments. This escalation in cyber threats compels businesses to invest in advanced security solutions to protect their applications and data. As a result, the demand for cloud native application protection platforms is likely to grow, as organizations seek to fortify their defenses against potential breaches and ensure the integrity of their cloud-based operations.

Increased Cloud Adoption in GCC

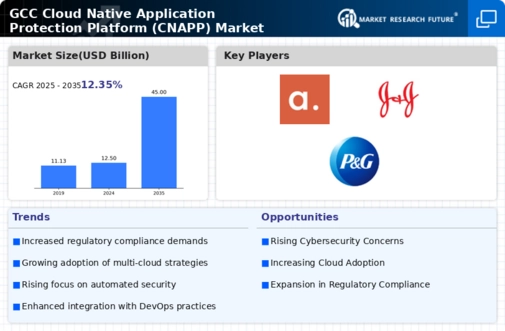

The GCC cloud native application protection platform market is experiencing a surge in cloud adoption across various sectors. Governments and enterprises are increasingly migrating their operations to cloud environments, driven by the need for scalability, flexibility, and cost efficiency. According to recent data, cloud adoption in the GCC region is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2026. This trend necessitates robust security measures, as organizations seek to protect sensitive data and applications in the cloud. Consequently, the demand for cloud native application protection platforms is likely to rise, as businesses prioritize security in their cloud strategies.

Integration of DevSecOps Practices

The GCC cloud native application protection platform market is witnessing a shift towards the integration of DevSecOps practices within development processes. Organizations are increasingly recognizing the importance of embedding security into the software development lifecycle, thereby enhancing the overall security posture of their applications. This trend is supported by the growing awareness of the need for proactive security measures in cloud environments. As companies adopt DevSecOps methodologies, the demand for cloud native application protection platforms that facilitate seamless integration of security into development workflows is expected to rise, further propelling market growth.

Regulatory Frameworks and Compliance

The GCC cloud native application protection platform market is significantly influenced by evolving regulatory frameworks aimed at enhancing data protection and privacy. Governments in the region are implementing stringent regulations, such as the UAE's Data Protection Law and Saudi Arabia's Personal Data Protection Law, which mandate organizations to adopt comprehensive security measures. These regulations create a pressing need for cloud native application protection solutions that ensure compliance while safeguarding sensitive information. As organizations strive to meet these legal requirements, the demand for specialized protection platforms is expected to increase, driving growth in the market.

Investment in Digital Transformation Initiatives

The GCC cloud native application protection platform market is benefiting from substantial investments in digital transformation initiatives across various sectors. Governments and enterprises are prioritizing the modernization of their IT infrastructure, which includes the adoption of cloud technologies. This shift towards digitalization creates a pressing need for robust security solutions to protect cloud-native applications. As organizations embark on their digital transformation journeys, the demand for cloud native application protection platforms is likely to increase, as they seek to ensure the security and compliance of their cloud-based operations.