Growing Cybersecurity Concerns

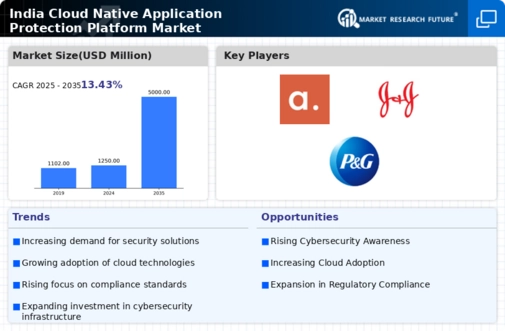

The increasing frequency of cyber threats in India has heightened the demand for robust security solutions, particularly in The India Cloud Native Application Protection Platform Market. Organizations are increasingly recognizing the need to protect their cloud-native applications from sophisticated attacks. According to recent reports, the cybersecurity market in India is projected to reach USD 13.6 billion by 2025, indicating a strong focus on security investments. This trend is likely to drive the adoption of cloud-native application protection platforms, as businesses seek to safeguard sensitive data and maintain compliance with regulatory requirements. The india cloud native application protection platform market is thus positioned to benefit from this growing awareness and urgency surrounding cybersecurity.

Rising Adoption of DevOps Practices

The adoption of DevOps practices in India is transforming the software development landscape, leading to an increased focus on security within the development lifecycle. This trend is particularly relevant to The India Cloud Native Application Protection Platform Market, as organizations seek to integrate security measures into their DevOps processes. By implementing security tools that align with DevOps methodologies, businesses can enhance their application security posture while maintaining agility. The growing emphasis on DevSecOps is likely to drive demand for cloud-native application protection solutions, as organizations aim to secure their applications from the outset. Thus, the india cloud native application protection platform market stands to benefit from this evolving approach to software development.

Government Initiatives and Regulations

The Indian government has been actively promoting digital transformation and cloud adoption through various initiatives, which indirectly bolster The India Cloud Native Application Protection Platform Market. Policies such as the Digital India initiative aim to enhance the country's digital infrastructure, thereby increasing the reliance on cloud services. Furthermore, regulations like the Personal Data Protection Bill emphasize the need for stringent data protection measures, compelling organizations to invest in cloud-native application protection solutions. As a result, the india cloud native application protection platform market is likely to experience growth driven by compliance requirements and government support for secure cloud adoption.

Increased Investment in Cloud Infrastructure

The surge in investment in cloud infrastructure across India is a pivotal driver for The India Cloud Native Application Protection Platform Market. As organizations expand their cloud capabilities, the need for comprehensive security solutions becomes paramount. Recent data indicates that the Indian cloud market is expected to grow at a CAGR of 30% from 2021 to 2025, reflecting a robust appetite for cloud services. This growth trajectory suggests that businesses will increasingly seek cloud-native application protection platforms to mitigate risks associated with cloud adoption. Consequently, the india cloud native application protection platform market is likely to thrive as organizations prioritize security in their cloud strategies.

Shift Towards Remote Work and Digital Transformation

The ongoing shift towards remote work and digital transformation in India has accelerated the adoption of cloud technologies, thereby influencing The India Cloud Native Application Protection Platform Market. Organizations are increasingly migrating their applications to the cloud to facilitate remote access and collaboration. This transition necessitates enhanced security measures to protect cloud-native applications from potential vulnerabilities. As per industry estimates, the cloud computing market in India is expected to reach USD 7.1 billion by 2025, indicating a significant opportunity for cloud-native application protection platforms. Consequently, the india cloud native application protection platform market is poised for growth as businesses prioritize security in their digital transformation journeys.