Rising Cybersecurity Threats

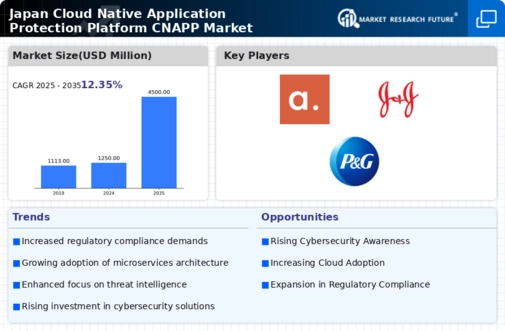

The Japan Cloud Native Application Protection Platform Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations in Japan are facing a myriad of security challenges, including ransomware attacks and data breaches. According to recent statistics, Japan has seen a notable rise in cyber incidents, prompting businesses to prioritize their cybersecurity strategies. This heightened awareness is driving investments in cloud-native security solutions, as companies seek to protect their applications and data in a rapidly evolving digital landscape. The need for robust security measures is further underscored by the Japanese government's initiatives to enhance national cybersecurity frameworks, thereby creating a conducive environment for the growth of the Cnapp market.

Shift Towards DevSecOps Culture

The Japan Cloud Native Application Protection Platform Market is witnessing a shift towards a DevSecOps culture, where security is integrated into the development and operations processes. This paradigm shift is driven by the recognition that security cannot be an afterthought in the software development lifecycle. Organizations in Japan are increasingly adopting DevSecOps practices to enhance collaboration between development, security, and operations teams. This integration fosters a proactive approach to security, enabling organizations to identify and mitigate vulnerabilities early in the development process. As a result, the demand for Cnapp solutions that facilitate this integration is on the rise, positioning the market for substantial growth in the coming years.

Government Initiatives and Support

The Japan Cloud Native Application Protection Platform Market benefits significantly from government initiatives aimed at bolstering cybersecurity. The Japanese government has implemented various policies and frameworks to promote the adoption of advanced security technologies. For instance, the Cybersecurity Strategy of Japan emphasizes the importance of securing cloud environments, which aligns with the objectives of Cnapp solutions. Additionally, financial incentives and grants are being offered to organizations that invest in cloud security measures. This governmental support not only encourages businesses to adopt Cnapp solutions but also fosters a collaborative ecosystem where public and private sectors work together to enhance overall cybersecurity resilience in Japan.

Growing Adoption of Cloud Services

The increasing adoption of cloud services in Japan is a pivotal driver for the Cloud Native Application Protection Platform Market. As organizations migrate their operations to the cloud, the need for comprehensive security solutions becomes paramount. Recent data indicates that over 80% of Japanese enterprises are utilizing cloud services, which necessitates the implementation of effective security measures to safeguard sensitive information. This trend is further amplified by the rise of remote work and digital transformation initiatives, compelling businesses to seek out Cnapp solutions that can provide visibility and control over their cloud environments. Consequently, the demand for solutions is expected to grow as organizations prioritize security in their cloud strategies.

Increased Focus on Compliance and Standards

The Japan Cloud Native Application Protection Platform Market is significantly influenced by the growing emphasis on compliance with various regulations and standards. Organizations are required to adhere to stringent data protection laws, such as the Act on the Protection of Personal Information (APPI), which mandates the safeguarding of personal data. This regulatory landscape compels businesses to implement robust security measures, including Cnapp solutions, to ensure compliance and avoid potential penalties. Furthermore, the alignment with international standards, such as ISO/IEC 27001, is becoming increasingly important for Japanese companies seeking to enhance their credibility and trustworthiness. Consequently, the focus on compliance is driving the adoption of Cnapp solutions, as organizations strive to meet regulatory requirements while securing their cloud-native applications.