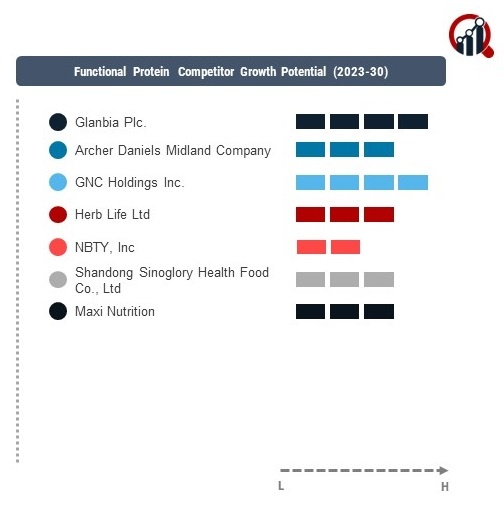

Top Industry Leaders in the Functional Protein Market

Competitive Landscape of the Functional Protein Market: Key Players, Strategies, and Market Dynamics

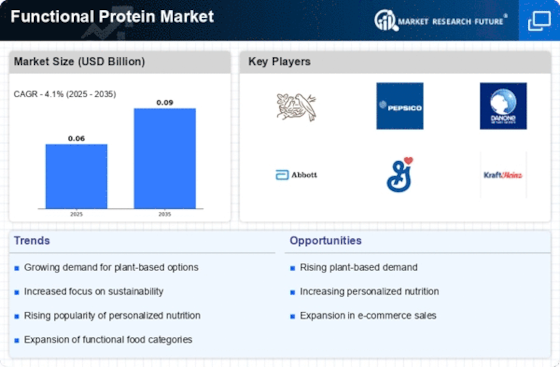

The functional protein market has experienced substantial growth driven by the increasing demand for protein-rich and functional food and beverage products. Key players in this sector are strategically positioning themselves to capitalize on the evolving health and wellness trends. This analysis provides insights into the key players, strategies adopted, factors influencing market share, emerging companies, industry trends, overall competitive scenario, and a recent development in 2023.

Key Players:

Glanbia Pic

Archer Daniels Midland Company

GNC Holdings Inc

Maxi Nutrition

Herbalife Ltd

Strategies Adopted:

- Product Innovation: Key players in the functional protein market prioritize product innovation to meet the dynamic demands of consumers. This involves developing new protein formulations, optimizing flavor profiles, and enhancing functionalities to align with the latest trends in health and wellness.

- Strategic Partnerships: Companies engage in strategic partnerships to expand their capabilities and market reach. Collaborative efforts with research institutions, universities, and other industry players enable access to cutting-edge technologies and facilitate joint ventures to explore new market segments.

- Diversification of Product Portfolio: Diversifying the product portfolio is a common strategy adopted by key players. This includes expanding offerings to include a variety of functional proteins, catering to different applications such as sports nutrition, weight management, and medical nutrition.

Market Share Analysis:

- Protein Purity and Quality: The purity and quality of functional proteins significantly impact market share. Companies that adhere to strict quality control measures and provide high-purity protein ingredients gain a competitive edge in the market.

- Application Versatility: The ability to offer functional proteins for diverse applications influences market share. Companies providing proteins suitable for sports nutrition, clinical nutrition, and functional foods can capture a broader market share.

- Research and Development Capabilities: The investment in research and development (R&D) capabilities is a crucial factor. Companies that continually invest in R&D to enhance the functionality and nutritional profile of their protein products stay competitive in the evolving market.

New & Emerging Companies:

- Beyond Meat: Beyond Meat is an emerging player in the functional protein market, specializing in plant-based proteins. The company is gaining recognition for its innovative approach to developing plant-based meat substitutes, contributing to the growing alternative protein market.

- Perfect Day: Perfect Day is a biotechnology company focused on producing functional proteins through fermentation. The company is emerging as a player in the alternative protein space, offering animal-free dairy proteins for various applications.

Industry Trends:

Recent industry developments highlight a growing trend towards sustainable and plant-based functional proteins. Major players are investing in technologies for sustainable protein production, including plant-based and fermentation methods. Additionally, there is increased attention to reducing the environmental impact of protein production, aligning with consumer preferences for eco-friendly and ethical products.

In terms of investment trends, companies are exploring technologies to enhance the bioavailability and functionality of proteins. Investments in novel processing techniques, bioinformatics, and advanced extraction methods contribute to developing proteins with improved functional attributes.

Competitive Scenario:

The competitive landscape of the functional protein market is dynamic, with established players adapting to emerging trends and new entrants exploring innovative solutions. The focus on product innovation, strategic collaborations, and sustainability remains central to the overall competitive scenario.

Recent Development

The functional protein market was the increased emphasis on personalized nutrition solutions. Major players introduced initiatives to offer customized functional protein products, allowing consumers to tailor their protein intake based on individual health and lifestyle needs. This development aligns with the broader trend towards personalized nutrition, recognizing the diverse and individualized dietary requirements of consumers. Companies invested in technologies and platforms that facilitate personalized nutrition, contributing to a more consumer-centric approach in the functional protein market. This shift towards personalized solutions reflects the industry's recognition of the importance of addressing individual health and wellness goals, providing consumers with tailored functional protein options for optimal nutritional outcomes.