Expansion of UAV Applications

The Fuel Cell UAV Market is expanding due to the diversification of UAV applications across various sectors. Industries such as agriculture, construction, and logistics are increasingly utilizing UAVs for tasks like crop monitoring, site surveying, and package delivery. Fuel cell UAVs, with their extended range and endurance, are particularly suited for these applications. The ability to operate for longer periods without refueling makes them an attractive option for businesses looking to enhance operational efficiency. As the demand for UAVs in these sectors continues to grow, the fuel cell segment is expected to capture a larger share of the market.

Regulatory Support and Incentives

The Fuel Cell UAV Market benefits from favorable regulatory frameworks and incentives that promote the adoption of clean energy technologies. Governments are implementing policies that encourage the use of fuel cell systems in UAVs, including tax credits and grants for research and development. These initiatives are designed to accelerate the transition to cleaner energy sources and reduce reliance on fossil fuels. As regulatory bodies continue to support the integration of fuel cell technology in UAV applications, the market is likely to see increased participation from various sectors, including agriculture, logistics, and surveillance.

Increasing Demand for Sustainable Solutions

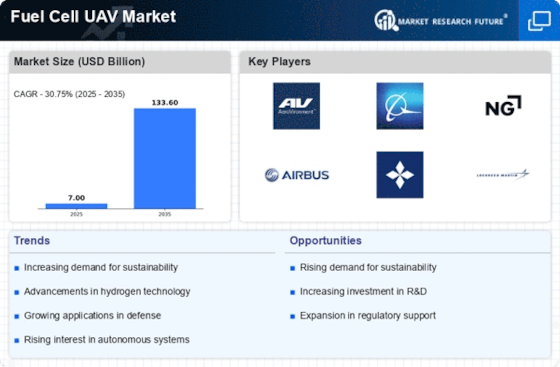

The Fuel Cell UAV Market is witnessing a growing demand for sustainable and environmentally friendly solutions. As industries and governments prioritize reducing carbon emissions, fuel cell technology offers a viable alternative to traditional fossil fuel-powered UAVs. Fuel cells produce zero emissions during operation, aligning with global sustainability goals. This shift is reflected in the increasing investments in research and development aimed at enhancing fuel cell efficiency and reducing costs. The market is expected to expand significantly as more organizations adopt fuel cell UAVs to meet their sustainability targets, potentially reaching a market size of several billion dollars by 2030.

Rising Investment in Research and Development

The Fuel Cell UAV Market is experiencing a notable increase in investment directed towards research and development. This influx of funding is aimed at overcoming existing challenges related to fuel cell efficiency, durability, and cost-effectiveness. Companies and research institutions are collaborating to innovate and refine fuel cell technologies, which is likely to lead to breakthroughs that enhance the overall performance of UAVs. As these advancements materialize, they are expected to drive market growth, with projections indicating a potential doubling of market size within the next decade as new applications and technologies emerge.

Technological Innovations in Fuel Cell Technology

The Fuel Cell UAV Market is experiencing a surge in technological innovations that enhance the efficiency and performance of fuel cells. Recent advancements in materials science, such as the development of lightweight and durable membranes, have improved the energy density of fuel cells. This has led to longer flight times and increased payload capacities for UAVs. Furthermore, the integration of advanced control systems and artificial intelligence is optimizing fuel cell operations, making them more reliable and user-friendly. As a result, the market is projected to grow at a compound annual growth rate of approximately 20% over the next five years, driven by these technological breakthroughs.

.png)