Government Policies and Incentives

Government policies and incentives play a pivotal role in shaping the Fuel Cell Commercial Vehicle Market. Many countries are implementing stringent emissions regulations that encourage the adoption of cleaner technologies, including fuel cells. Financial incentives, such as tax credits and grants for purchasing fuel cell vehicles, are becoming more common. For example, certain regions have established funding programs to support the development of hydrogen infrastructure, which is essential for the widespread adoption of fuel cell vehicles. These initiatives not only lower the initial investment barrier for fleet operators but also stimulate research and development in fuel cell technologies. As governments continue to prioritize sustainability and carbon reduction, the Fuel Cell Commercial Vehicle Market is likely to benefit from increased support and investment, fostering a more favorable environment for growth.

Rising Demand for Sustainable Transportation

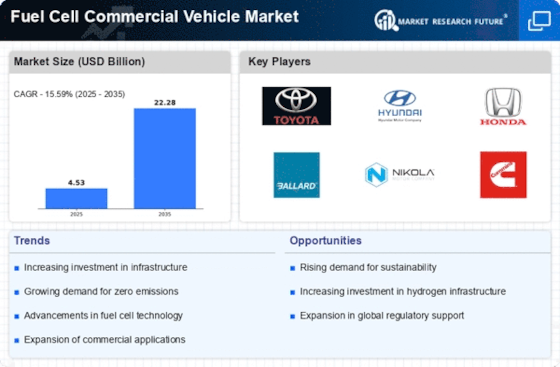

The growing demand for sustainable transportation solutions is a significant driver for the Fuel Cell Commercial Vehicle Market. As environmental awareness increases, businesses and consumers alike are seeking alternatives to fossil fuel-powered vehicles. The transportation sector is a major contributor to greenhouse gas emissions, prompting a shift towards cleaner technologies. Fuel cell vehicles, which emit only water vapor, present a viable solution to meet these sustainability goals. Market data indicates that the demand for fuel cell commercial vehicles is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This trend is further supported by corporate sustainability initiatives, where companies are committing to reducing their carbon footprints. Consequently, the Fuel Cell Commercial Vehicle Market is poised for significant expansion as it aligns with the global push for greener transportation options.

Corporate Sustainability Goals and Initiatives

Corporate sustainability goals and initiatives are increasingly influencing the Fuel Cell Commercial Vehicle Market. Many companies are setting ambitious targets to reduce their carbon emissions and transition to cleaner energy sources. This shift is prompting businesses to explore fuel cell vehicles as a viable option for their fleets. The operational efficiency and lower emissions associated with fuel cell technology align well with corporate sustainability objectives. Market analysis indicates that a growing number of logistics and transportation companies are investing in fuel cell vehicles to enhance their green credentials. This trend is likely to accelerate as stakeholders demand greater accountability in environmental performance. As corporations prioritize sustainability, the Fuel Cell Commercial Vehicle Market stands to gain traction, driven by the need for innovative solutions that meet both operational and environmental goals.

Infrastructure Development for Hydrogen Fueling

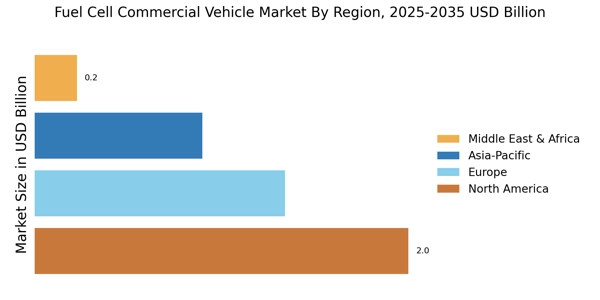

Infrastructure development for hydrogen fueling stations is crucial for the growth of the Fuel Cell Commercial Vehicle Market. The availability of a robust hydrogen supply network directly impacts the feasibility of fuel cell vehicles for commercial use. Recent investments in hydrogen infrastructure are being made to establish a comprehensive network of fueling stations, which is essential for supporting long-haul transportation and logistics operations. For instance, several countries are collaborating with private sector partners to expand hydrogen refueling capabilities, aiming to increase accessibility for fleet operators. This infrastructure expansion not only alleviates range anxiety among potential users but also enhances the overall attractiveness of fuel cell vehicles. As the infrastructure matures, it is likely to catalyze further adoption of fuel cell technology in the commercial vehicle sector, thereby propelling the Fuel Cell Commercial Vehicle Market forward.

Technological Advancements in Fuel Cell Technology

The Fuel Cell Commercial Vehicle Market is experiencing rapid technological advancements that enhance the efficiency and performance of fuel cell systems. Innovations in materials, such as proton exchange membranes and catalysts, are leading to improved energy density and reduced costs. For instance, advancements in hydrogen storage solutions are enabling longer ranges for commercial vehicles, which is crucial for logistics and transportation sectors. The integration of fuel cells with electric drivetrains is also becoming more prevalent, allowing for hybrid systems that optimize energy use. As these technologies mature, they are expected to drive down the total cost of ownership for fleet operators, making fuel cell vehicles more attractive compared to traditional diesel options. This trend suggests a promising future for the Fuel Cell Commercial Vehicle Market as it aligns with the increasing demand for sustainable transportation solutions.