Collaborative Industry Efforts

Collaborative efforts among various stakeholders in the Japan Hydrogen Fuel Cell Vehicle Market are fostering innovation and market growth. Partnerships between automotive manufacturers, energy companies, and research institutions are essential for advancing hydrogen technologies and infrastructure. For instance, joint ventures aimed at developing hydrogen production and distribution systems are becoming increasingly common. These collaborations not only enhance technological capabilities but also facilitate knowledge sharing and resource optimization. As the industry continues to unite around common goals, the collective impact on the hydrogen fuel cell vehicle market is expected to be profound, driving further adoption and investment.

Rising Environmental Awareness

Increasing environmental awareness among consumers and businesses is a pivotal driver for the Japan Hydrogen Fuel Cell Vehicle Market. As concerns regarding air pollution and climate change escalate, there is a growing demand for sustainable transportation solutions. Hydrogen fuel cell vehicles, which emit only water vapor, are perceived as a viable alternative to traditional fossil fuel-powered vehicles. This shift in consumer sentiment is reflected in the rising sales of FCVs, which reached approximately 10,000 units in 2025. The heightened focus on reducing carbon footprints is likely to propel further investments in hydrogen technologies and infrastructure.

Government Incentives and Subsidies

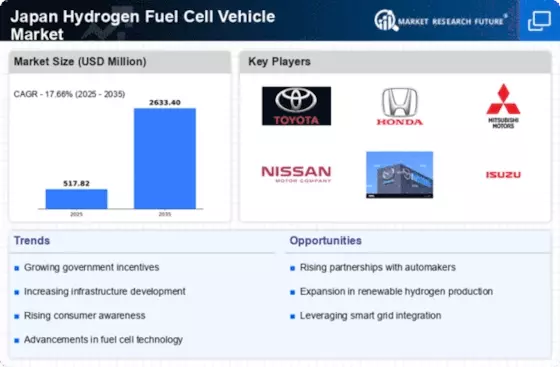

The Japan Hydrogen Fuel Cell Vehicle Market benefits significantly from government incentives and subsidies aimed at promoting clean energy technologies. The Japanese government has established various financial support mechanisms, including grants and tax reductions, to encourage the adoption of hydrogen fuel cell vehicles (FCVs). For instance, the government has set a target of having 800,000 FCVs on the road by 2030, which is supported by substantial funding for research and development. This proactive approach not only stimulates consumer interest but also fosters collaboration between automakers and energy providers, thereby enhancing the overall market landscape.

Expansion of Hydrogen Refueling Infrastructure

The expansion of hydrogen refueling infrastructure is a vital driver for the Japan Hydrogen Fuel Cell Vehicle Market. The Japanese government has committed to increasing the number of hydrogen refueling stations, with a target of 1,200 stations by 2030. This initiative aims to alleviate range anxiety among potential FCV buyers and enhance the overall convenience of hydrogen vehicles. As of January 2026, there are approximately 400 operational refueling stations across Japan, indicating a steady growth trajectory. The establishment of a robust refueling network is likely to encourage more consumers to consider hydrogen fuel cell vehicles as a practical alternative.

Technological Innovations in Fuel Cell Technology

Technological advancements in fuel cell technology are crucial for the growth of the Japan Hydrogen Fuel Cell Vehicle Market. Innovations such as improved fuel cell efficiency, reduced production costs, and enhanced durability are making hydrogen vehicles more competitive with battery electric vehicles. For example, recent developments have led to fuel cells that can operate effectively in a wider range of temperatures, thereby expanding their applicability. As automakers continue to invest in research and development, the performance and affordability of hydrogen fuel cell vehicles are expected to improve, potentially increasing market penetration.