Rising Demand for Processed Foods

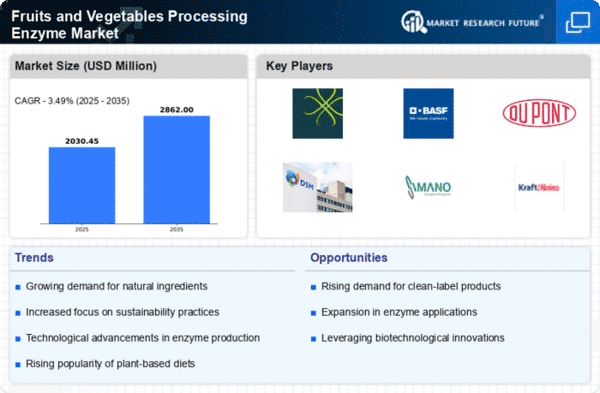

The Global Fruits and Vegetables Processing Enzyme Market Industry experiences a notable surge in demand for processed foods, driven by changing consumer lifestyles and preferences. As urbanization increases, consumers seek convenient and ready-to-eat options, which often require enzymatic processing to enhance flavor, texture, and shelf-life. This trend is reflected in the projected market value of 1.91 USD Billion in 2024, indicating a growing reliance on enzymes to meet consumer expectations. The processing enzymes facilitate the breakdown of complex carbohydrates and proteins, thereby improving the overall quality of processed fruits and vegetables. Consequently, this demand is likely to propel the market forward.

Regulatory Support for Food Safety

Regulatory frameworks promoting food safety and quality standards significantly impact the Global Fruits and Vegetables Processing Enzyme Market Industry. Governments worldwide are increasingly implementing stringent regulations to ensure the safety of food products, which often necessitates the use of processing enzymes. These enzymes help in reducing microbial load and enhancing the safety of processed fruits and vegetables. Compliance with these regulations not only assures consumers of product safety but also encourages manufacturers to adopt enzymatic solutions. As a result, the market is expected to witness steady growth, driven by the need for safer food processing methods.

Health Consciousness Among Consumers

The increasing health consciousness among consumers plays a pivotal role in shaping the Global Fruits and Vegetables Processing Enzyme Market Industry. As individuals become more aware of the nutritional benefits of fruits and vegetables, there is a growing preference for products that retain their natural qualities. Enzymes are essential in preserving the nutritional content and enhancing the digestibility of processed foods. This trend is further supported by the rising demand for clean-label products, which often utilize enzymes for natural processing. The market is likely to benefit from this shift, as consumers actively seek healthier options, thereby driving growth in the enzyme sector.

Sustainability Initiatives in Food Processing

Sustainability initiatives within the food processing sector are becoming increasingly relevant to the Global Fruits and Vegetables Processing Enzyme Market Industry. As environmental concerns rise, food manufacturers are seeking ways to minimize waste and reduce their carbon footprint. Enzymes play a crucial role in this endeavor by optimizing processing efficiency and reducing energy consumption. For instance, the use of enzymes can lead to lower water usage and waste generation during processing. This alignment with sustainability goals is likely to attract investment and innovation in the enzyme market, fostering growth as companies strive to meet both consumer and regulatory expectations.

Technological Advancements in Enzyme Production

Advancements in biotechnology and enzyme production techniques significantly influence the Global Fruits and Vegetables Processing Enzyme Market Industry. Innovations such as recombinant DNA technology and enzyme engineering enhance the efficiency and specificity of enzyme production. These developments not only reduce production costs but also improve the performance of enzymes in processing applications. As a result, manufacturers can offer more effective solutions to food processors, thereby increasing market penetration. The integration of these technologies is expected to contribute to the market's growth, with projections indicating a market value of 2.77 USD Billion by 2035, showcasing the potential for continued innovation.